South Africa’s economy picked up momentum in the first quarter of the year, but historic flooding in a key province and the threat of unprecedented power cuts are putting the brakes on its recovery.

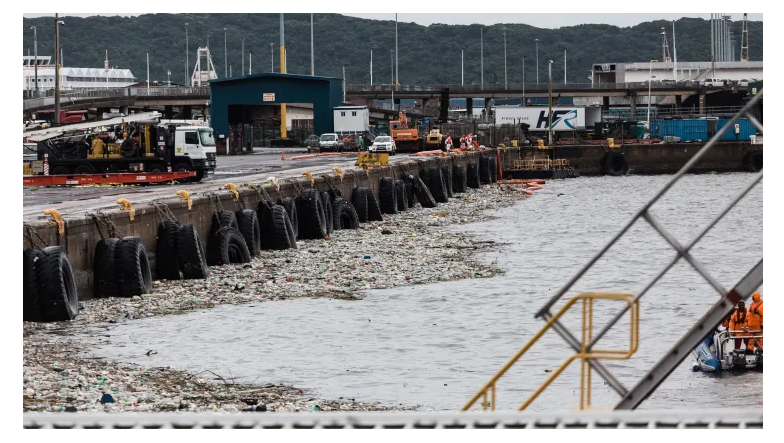

The port city of Durban and the wider KwaZulu-Natal province in eastern South Africa were besieged by the country’s worst flash flooding for decades in April, which killed hundreds and throttled freight operations at sub-Saharan Africa’s busiest port.

The Absa/BER manufacturing PMI — having soared to a record high of 60.0 in March — slumped to 50.7 in April, its lowest reading since the violent riots following former President Jacob Zuma’s arrest in July last year.

KwaZulu-Natal, South Africa’s second-most populous province, was also the center of the country’s worst riots since the end of apartheid.

The S&P Global composite PMI also fell to a four-month low, and in a note last week, Capital Economics highlighted that high frequency data indicates that the recovery in mobility has stalled.

The figures for the first quarter paint a mixed picture, according to JPMorgan economists Sthembiso Nkalanga and Sonja Keller, but point to a seasonally adjusted quarterly GDP growth of 3.5%.

However, April’s dismal PMI showing poses downside risk to JPMorgan’s 1.5% GDP growth projection for the second quarter. Alongside the global backdrop of the war in Ukraine, soaring inflation and Chinese supply struggles, South Africa is also dealing with the domestic shocks of flooding and electricity rationing.

Much of the decline in the manufacturing PMI was concentrated on port and manufacturing activity in KwaZulu-Natal, where manufacturing activity dropped from 60.5 in March to 39.6 in April.

Load shedding — the deliberate shutdown of power in parts of an electricity system to prevent its failure when overburdened — scaled up significantly in April, with electricity cuts this year projected to exceed the already substantial quantities seen in 2021.

JOHANNESBURG, South Africa: Soweto residents picket near the entrance to state entity Eskom Offices at Megawatt Park in Midrand, near Johannesburg, on June 9, 2021 due to the ongoing electricity disruptions. Eskom, on June 9, 2021 announced it will implement nationwide power cuts due to rising consumption as the cold weather sets in and breakdowns at two power plants.

Even as the floods have largely abated, electricity supply cuts pose a consistent problem for the South African economy.

State-owned utility Eskom’s electricity availability factor — which measures the available electricity as a share of maximum amount of electricity that could be produced — has been stuck near record lows in recent weeks, noted Jason Tuvey, senior emerging markets economist at Capital Economics.

Minister of Public Enterprises Pravin Gordhan has cautioned that Eskom could resort to stage 8 load shedding, which would entail blackouts for up to 12 hours a day, in order to avert a total collapse of the country’s electricity grid.

“Some shocks such as the flooding are clearly outside of the government’s control but, even without these, the recovery will continue to be held back so long as issues such as those affecting the electricity sector remain unresolved,” Tuvey said.

The International Monetary Fund is projecting real GDP growth, adjusted for inflation, of 1.9% for South Africa in 2022.

Eskom on Thursday announced the implementation of stage 2 load shedding between 5 p.m. and 10 p.m. local time.

“The onset of winter has seen increased demand and this will lead to capacity constraints throughout this period, particularly during the evening and morning peaks. Unfortunately, this would generally require the implementation of loadshedding during the evening peaks,” it said in a statement.

Eskom reiterated that loadshedding is a “last resort to protect the national grid” and urged South Africans to continue using electricity “sparingly,” particularly in the early mornings and evenings.

Possible Q2 contraction

The government declared a state of disaster in response to the floods and has begun efforts to repair the damage.

“Yet, we expect the April slide to reverse more slowly than the swift rebound seen after the unrest last July, given the damage to road infrastructure, as well as the delays at the ports,” JPMorgan’s Nkalanga and Keller said in their latest research note.

“Meanwhile, energy availability is down significantly this year, raising the risks of prolonged power cuts, while the consumer resiliency that likely led the GDP growth in 1Q should fade this quarter due to a purchasing power squeeze.”

Against this backdrop and the sensitivity of the South African economy to changes in external market conditions, including global supply chain problems, a potential growth slowdown in China and the war in Ukraine, JPMorgan sees “increased risk of slower GDP growth or even a contraction this quarter.”

cnbc.com