Ethiopia’s government decision to change banknotes and issue higher denomination bill would have significant importance to curb the rampant illicit money transfer and circulation of false money whilst facilitating transactions, according to a finance expert.

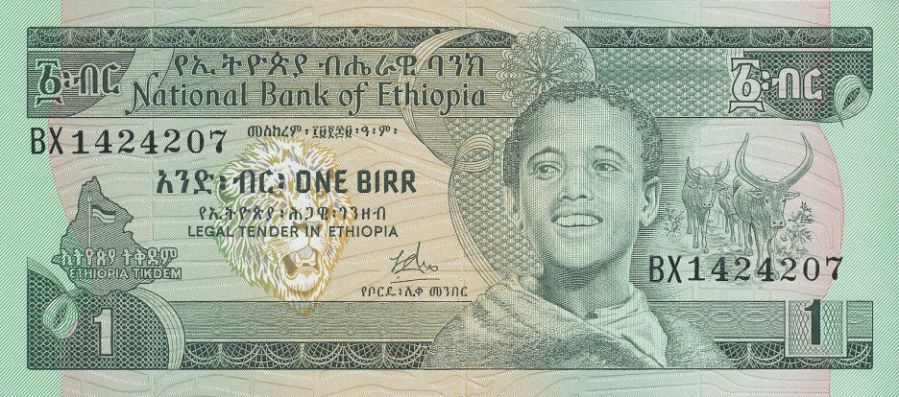

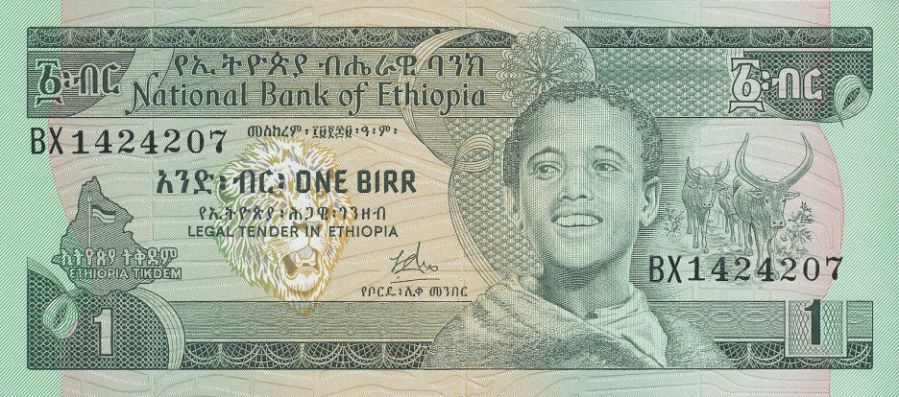

Prime Minister Abiy Ahmed announced yesterday that the existing 10,50 and 100 Birr notes are replaced with new notes that are equipped with major security features and improvements. The country also obtained a higher denomination, a 200- Birr banknote for the first time in its history.

The Premier said the new banknotes will curb financing of illegal activities; corruption and contraband. “Enhanced security features on the new notes will also cease counterfeit production.” Indicating that preparations have been finalized to tackle illicit money transfer and counterfeiting, he underscored that those engaging in such illegal activities would be met with a serious legal measure.

Various measures were taken to protect and grow the banking sector that includes the lifting of a previously mandatory 27 per cent bond purchase policy, he indicated.

The premier also unveiled that the country spent 3.7 billion Birr to print the new banknotes.

Speaking to The Ethiopian Herald, Business Lecturer at Addis Ababa University, Mukemil Bedru said that the change in banknotes is giving due consideration for the fact that illicit money transfer reached at an alarming rate in the country. Thus, the change is instrumental to manage illicit financing thereby contributing to the national economy.

The expert, who is also Board Chairman of Hijra Bank (Under formation), stated that the government should replace the existing banknotes within short period thereby keeping the country out of the liquidity crisis that could result from limitations in the provision of the new print money. Though the country may face some liquidity shortage for short period, the decision will remarkably bank the unbanked society thereby enhancing the money circulation and expanding the liquidity base as well as widening government’s tax base.

Concerning cash withholding, Mukemil indicated that only 36-38 per cent of Ethiopian adults have access to bank and a massive amount of money is circulated outside the country’s financial system and unregulated. “Once the decision has come over the challenges encountered in the early stages, it will have paramount importance to inject enormous money in the financial sector whilst the source is identifiable and traceable.”

He further pointed out that the decision would also have a role to transform Ethiopia’s large informal sector to formal one and enhance government’s capacity to collect taxes that would, in turn, expand public expenditure and investment in infrastructural projects.

Expressing his expectation of a 500-Birr banknote, Mukemil said that the government’s decision to issue a higher denomination bill is crucial as the country has been in double-digit inflation for the past few years thereby requiring people to carry much cash to make transactions. Higher denomination banknote is important to facilitate transactions and reduce the cost of printing money.

“Illicit money transfer has been increasing over the last years and government’s measure is delayed,” he noted, adding that the problem is serious and needs multiple interventions in addition to changing the banknotes. Enforcing and revising the cash withdrawal cap that was introduced to limit the amount of money that individuals and companies allow to withdraw from banks has a vital role to deter illicit money transfer.

The expert highlighted that enhancing the digital payment platforms including mobile and electronic banking services allow the government to effectively monitor the money circulation and boost its revenue. Alerting banks to provide appealing service to customers in a way that encourages the latter to open bank accounts and utilizing agency banking are also needed equal consideration.

Most of the print work of the new currency notes are currently in the country within NBE vault. Distribution mechanism and planning having been developed and will go in effect through concerned bodies. Security plays a key component in the currency change process and relevant authorities together with members of the community will enforce secure implementation. A Federal command post that includes National Defense, NISS and Federal Police will be set up to oversee this process with the expectation that Regional Command Posts will also be set up.

While Ethiopia has never had a symbol to represent its currency, a new symbol has been designed and will be soon unveiled to symbolize the Birr, it was learnt.