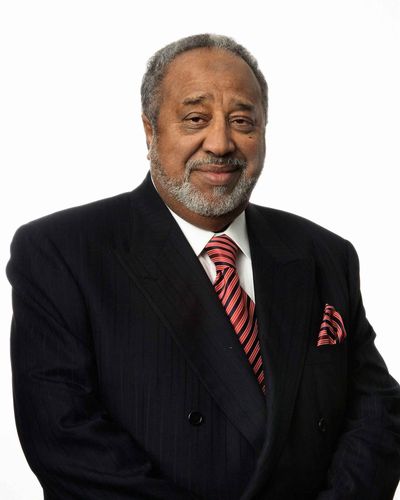

Prince Alwaleed bin Talal in 2013. Photographer: Piero Cruciatti/Alamy

When the Saudi king had dozens of powerful princes and businessmen arrested on Nov. 4 in a crackdown on corruption, none of the names grabbed global attention quite like that of Prince Alwaleed bin Talal. The world’s 61st-richest person, the royal is practiced at grabbing attention. For decades he’s been a celebrity on Wall Street, known for his sizable stakes in companies such as Citigroup, Apple, Twitter, and Lyft and a tabloid-friendly embrace of excess. The owner of a 282-foot superyacht he bought from Donald Trump, Alwaleed flies around in a retrofitted Boeing 747 and has a zoo at his private palace.

The defining feature of Riyadh’s skyline is Kingdom Centre, a 992-foot-tall glass edifice he built in 2002 that serves as his headquarters. Its curved sky bridge is visible across much of the city. The tower is 9 miles away from where Alwaleed and others are rumored to be detained at the Ritz-Carlton. (He owns the rival Four Seasons across town.) Other detainees, such as the former head of the country’s powerful National Guard, are a more direct political threat to the purge’s initiator, Crown Prince Mohammed bin Salman, but Alwaleed’s global influence is palpable. He’s been charged with money laundering, bribery, and extortion, according to a senior Saudi official.

Alwaleed’s $17 billion fortune is comparatively self-made, as princely fortunes go. As he tells it, his investment group, Kingdom Holding Co., which has a market capitalization of $8 billion, was seeded in 1979 with a $30,000 gift from his father and a home-equity loan. At first he kept to the typical dealings of entrepreneurial princes: trading land and acting as a key man for foreign companies seeking a foothold in the kingdom. But around 1990, Alwaleed began buying shares in Citigroup Inc. predecessor Citicorp, whose balance sheet had taken a hit from soured real estate loans. In February 1991, Chief Executive Officer John Reed asked for a cash infusion, and Alwaleed sunk another half-billion dollars into the bank, bringing the size of his holdings to almost $800 million.

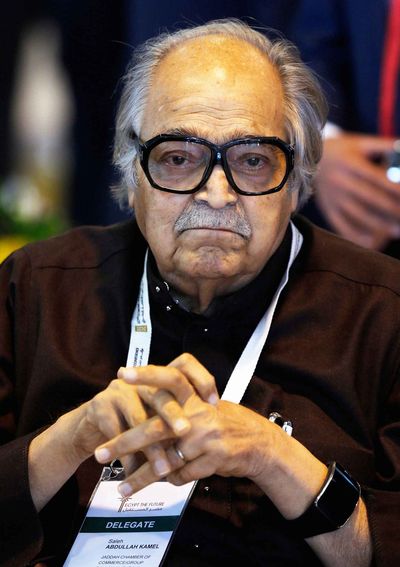

Photographer: Hans Berggren

Over the next two decades, the prince scooped up stakes in dozens of high-profile companies, including Saks, News Corp., and Netscape. He developed a taste for hotels, acquiring some of the world’s most prestigious properties, from the Plaza in New York to the George V in Paris. In 2007 he teamed up with Bill Gates’s private investment company to take the Four Seasons hotel chain private in a $3.4 billion deal.

By the turn of the century, Alwaleed was often referred to in the press as the Warren Buffett of Arabia, a comparison he embraced. His stake in Citigroup had soared more than 190 percent in the 10 years through 2001, but many of his investments were duds. He invested $345 million in ill-fated Euro Disney in 1994 and binged on dot-com companies at the peak of the 2000 bubble. In 2005 he sold the bulk of his stake in Apple Inc., telling Bloomberg at the time that “the benefits of the iPod and all the good moves Steve Jobs has made have already been put in the price.”

Alwaleed upped his Citigroup stake in November 2008, even after shares had plummeted in the financial crisis. As of December 2016, he owned about 4.7 percent of Twitter Inc., according to regulatory filings by the social media company. He was an important ally of Rupert Murdoch as a large holder of 21st Century Fox Inc. voting shares, but Bloomberg data show that he recently sold his stake.

Alwaleed hasn’t neglected investing in his home market, and it’s likely he’s done well with those investments. The Saudi stock exchange’s benchmark index has more than tripled since 1994, powered by an oil boom that pushed prices above $100 a barrel before waning in recent years. As of June 30, Alwaleed valued his investments in the Middle East, including equities, the media company Rotana Group, and Saudi land, at almost $6.5 billion.

Photographer: Amr Abdallah Dalsh/Reuters

Demanding and conscious of appearances—including his standing on global rich lists—Alwaleed has had “something of a mixed reputation” outside the kingdom, says Marcus Chenevix, an analyst at investment research firm TS Lombard in London. “International investors see him as a man who talks a very big game and sometimes performed, but often didn’t,” he says. Still, Alwaleed has been for much of the world an unofficial ambassador of Saudi Arabia and its spending power. He’s been modern and outward-looking, if sometimes ostentatious, in a country better known for secrecy and severe conservatism. Alwaleed has pushed for the right of Saudi women to drive and work. He hired the country’s first female pilot to fly his private jets, and most of his staff are women.

Such views make it all the more unusual that he was targeted in the crackdown, says Jane Kinninmont, an analyst at Chatham House, a London-based think tank. The 32-year-old Prince Mohammed, the heir to the throne who’s seen as wielding most of the power in the kingdom, has made liberalizing Saudi Arabia’s stringent religious strictures a cornerstone of his agenda. In public, Alwaleed has only praised the crown prince. Still, there might be some mistrust of someone who has a track record of being outspoken. Prince Mohammed could also be wary of Alwaleed’s branch of the royal family. The billionaire’s father, known as the “red prince,” was exiled in the 1960s for criticizing the royal family.

The decision to arrest the country’s most prominent global investor, a partner of Gates and a friend to Murdoch, seems risky at a moment when the crown prince has been courting foreign capital. The kingdom is trying to sell a stake in its state-owned oil company in what could be the largest-ever initial public offering.

The shares of Alwaleed’s Kingdom Holding fell 21 percent in the four days following the first reports of the crackdown. But gauging the financial fallout from the arrest is complicated by the opacity of his holdings. Kingdom Holding’s free float is only 5 percent, which makes it more difficult for investors to trade shares. The company also doesn’t specify the exact size of its public stakes, and many of Alwaleed’s interests fall below the disclosure threshold and don’t have to be reported in filings. The billionaire often invests personally in equities, alongside Kingdom Holding. He’s declined repeated requests for details on his public and private assets. In a Nov. 6 statement, Kingdom’s CEO said the company “enjoys a solid financial position.”

The biggest unanswered question is whether Alwaleed is a victim of a brash attempt by Prince Mohammed to consolidate power or just another corrupt royal at long last brought to heel. The governor of the Saudi Arabian Monetary Authority said on Nov. 7 that they froze personal bank accounts of individuals in the crackdown but not those of their companies. If that were to change, it would indicate the crown prince was angling to take down a rival, says Kinninmont. “The government is very much trying to send a message that these arrests are about cleaning up to make a better environment for investing,” she says. “If they were to seize Alwaleed’s stakes in major international companies, that would really muddy the waters.”