Ghana’s central bank may cut its key interest rate for a third straight meeting with inflation at its slowest in four years and a strengthening currency.

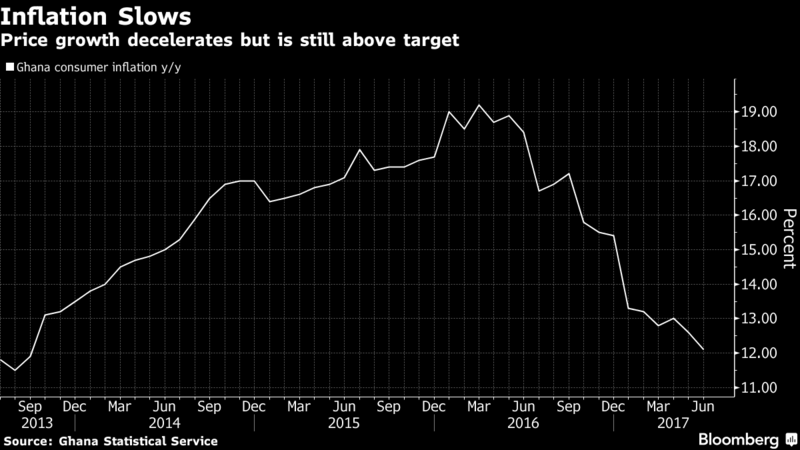

Consumer-price growth has tumbled 7.1 percentage points since reaching an all-time high of 19.2 percent in March last year. While the cedi weakened to a record low against the dollar on March 2, it has strengthened 8 percent since then. The median of seven economists’ estimates is for a 100 basis-point cut in the key rate to 21.5 percent on Monday.

“Persistent inflation is unlikely to halt Ghana’s monetary easing,” Mark Bohlund, an economist at Bloomberg Intelligence, said in a report. “The stronger cedi should moderate price increases in coming months.”

The lender sees price growth slowing into the target band of 6 percent to 10 percent in 2018.

The government of President Nana Akufo-Addo, who came to power after winning a December election, has vowed to boost growth from last year, when the economy expanded at its slowest rate in more than a quarter of a century.

There are signs of improvement, with west Africa’s biggest economy after Nigeria’s expanding 6.6 percent in the first quarter, the most in almost three years, as new oil fields started pumping crude.

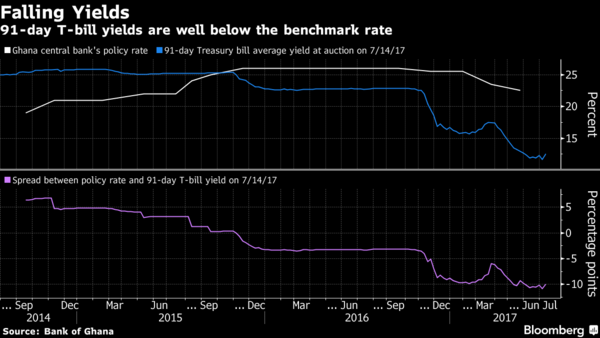

The central bank will announce the rate decision at 11 a.m. on Monday in the capital, Accra. While it has cut the benchmark by 300 basis points this year, that trails the 420 basis-point decline in the 91-day Treasury bill rate. The bill yield may fall to 11.2 percent by the end of 2017, Razia Khan, London-based head of Africa macro research at Standard Chartered Bank Plc, said in a note to clients.

Since falling to a record in March, the cedi has strengthened to become Africa’s best-performing currency after Mozambique’s metical and Zambia’s kwacha. Ghana, which is the world’s biggest cocoa producer after Ivory Coast, is raising about $1.3 billion through a loan to buy beans in the new season, and is in the advanced stages of issuing a $2.4 billion bond to service energy-industry debt.

“More foreign-exchange inflows from cocoa syndicated loan and anticipated bonds issuance will favor the currency,” Courage Martey, economist at Accra-based Databank Group, said by phone.