Banks in Liberia are trying to manage the shortage of local Liberian dollars as the commerce ministry warned businesses that they must accept both Liberian and US dollars or face large fines. Customers are queuing up at banks to withdraw money from their accounts or cash paychecks.

The scarcity of local currency has led to several businesses rejecting the United States dollar previously in demand.

“We have noticed that there are lots of businesses that started refusing the US dollar and insisting that customers purchase in Liberian dollars only,” said Liberian Minister of Commerce and Industry Mawine G. Diggs during an emergency meeting at the Legislature on Thursday.

The shortage has resulted in a drop in the exchange rate from L$199 to L$150 for US$1.

The cash shortage is affecting all sectors of the country’s economy. Second-hand shoe salesman Jefferson Gbaytain, 39, said it had reduced his purchasing power.

“We are really struggling with the business. There are no customers because of the scarcity of the local currency,” he told RFI from his stand in Waterside, a commercial hub in the capital Monrovia.

Despite the scarcity of the Liberian dollar, prices of goods on the local market continue to increase, which makes it harder for the average Liberian to get by.

“For now you find the United States dollar more easily than the Liberian dollar. We are totally confused as to what exactly is unfolding,” added Gbaytain.

Meanwhile, groundnut seller Miatta Sheriff, 47, says her steady flow of customers has decreased since the financial crisis.

“I usually sell and earn L$3,000 daily but for the past two weeks I am yet to get L$1,000 from my sales,” she said sadly.

Banks run out of cash

Commercial banks have run out of local currency due to the shortage of banknotes across the country. Public sector employees cannot get access to the Liberian dollar component of their salary due to the crisis.

“I have been here for the last four days, the bank keeps saying their system is down because there are no Liberian dollars in the bank,” said Andrew Williams, a public school teacher who was standing outside the bank.

“How do we survive? What sort of country are we living in?” he added.

At the Ecobank office on Ashmun Street in Monrovia, several customers walked past ATM machines and demanded to enter the main banking hall because the machine had run out of cash.

Liberian dollar blame game

A number of financial experts are blaming business people for allegedly withholding the Liberian banknotes and keeping money at home, which is affecting the economy.

“This year we saw an early surge in withdrawal of Liberian dollars from the system (commercial banks),” said Access Bank Manager Sergii Blyzriuk.

“Deposits are no longer coming into the banking system; what we are witnessing since October is withdrawals,” Blyzriuk explained.

Liberia’s Central Bank Governor Aloysius Tarlue attributed the Liberian dollar liquidity problem to the effect of Covid-19 on the economy, but said it has begun working with various stakeholders, as well as the International Monetary Fund, the legislature and others, to find a lasting solution.

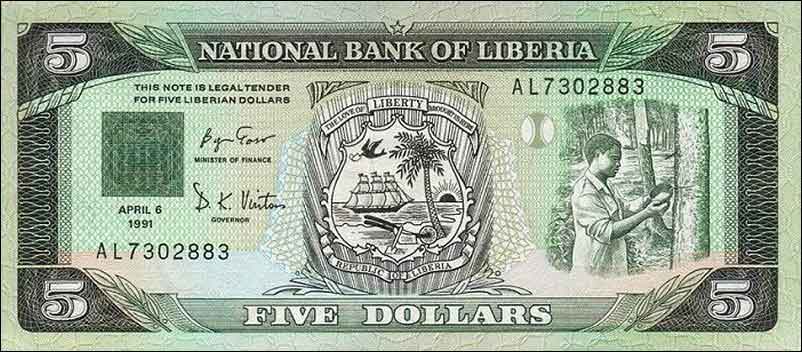

Printing local currency

The bank is currently supplying commercial banks with more liquidity, but says it will be done gradually to maintain low inflation volatility aimed at protecting the purchasing power of ordinary citizens.

“We had requested the printing of 7.5 billion Liberian dollars in 2019, but the Legislature only approved four billion at the time,” said Tarlue.

“This means with increasing demands… the need now for the printing of more liquidity cannot be overemphasized,” he added.

Liberia has printed a little over 20 billon Liberian dollars of local currency since 2016, but the whereabouts of that money remains a big question.

However, legislative approval has been granted to the Central Bank to print new sets of banknotes to replace the current currency in circulation, said House of Representatives Banking Chair Dixon Seboe.

“We have agreed that as a country we will change our entire currency and that approval has been given to the Central Bank,” Seboe said on a local radio station in Monrovia.