First up, China: Retail sales in China grew 7.2% in October compared to a year prior, below the 7.9% increase expected by analysts polled by Refinitiv. Industrial output, meanwhile, grew 4.7%, which was also weaker than anticipated.

“Downward pressure has continued to increase on the economy,” China’s national statistical authority said in a statement.

China’s massive economy is already growing at the slowest pace since 1992, but signs of further deterioration helped push stocks down in Asia. The silver lining? “Looking through all the volatility and base effects, we see a picture of fragile stabilisation, of weak growth, rather than another sharp deceleration,” economists at Societe Generale said in a research note.

And in Europe: At first glance, there was better news out of Germany.

Europe’s largest economy narrowly avoided a recession in the third quarter, expanding by 0.1% over the previous three-month period. Still, the outlook for Germany remains poor. Here’s what Andrew Kenningham, chief Europe economist at Capital Economics, gleaned from the data: “The trivial increase in GDP in Q3 means that Germany has narrowly averted a technical recession. But second-quarter GDP fell more than previously thought, and we think the economy will probably contract slightly next year — so a recession may have been postponed rather than avoided altogether,” he said.

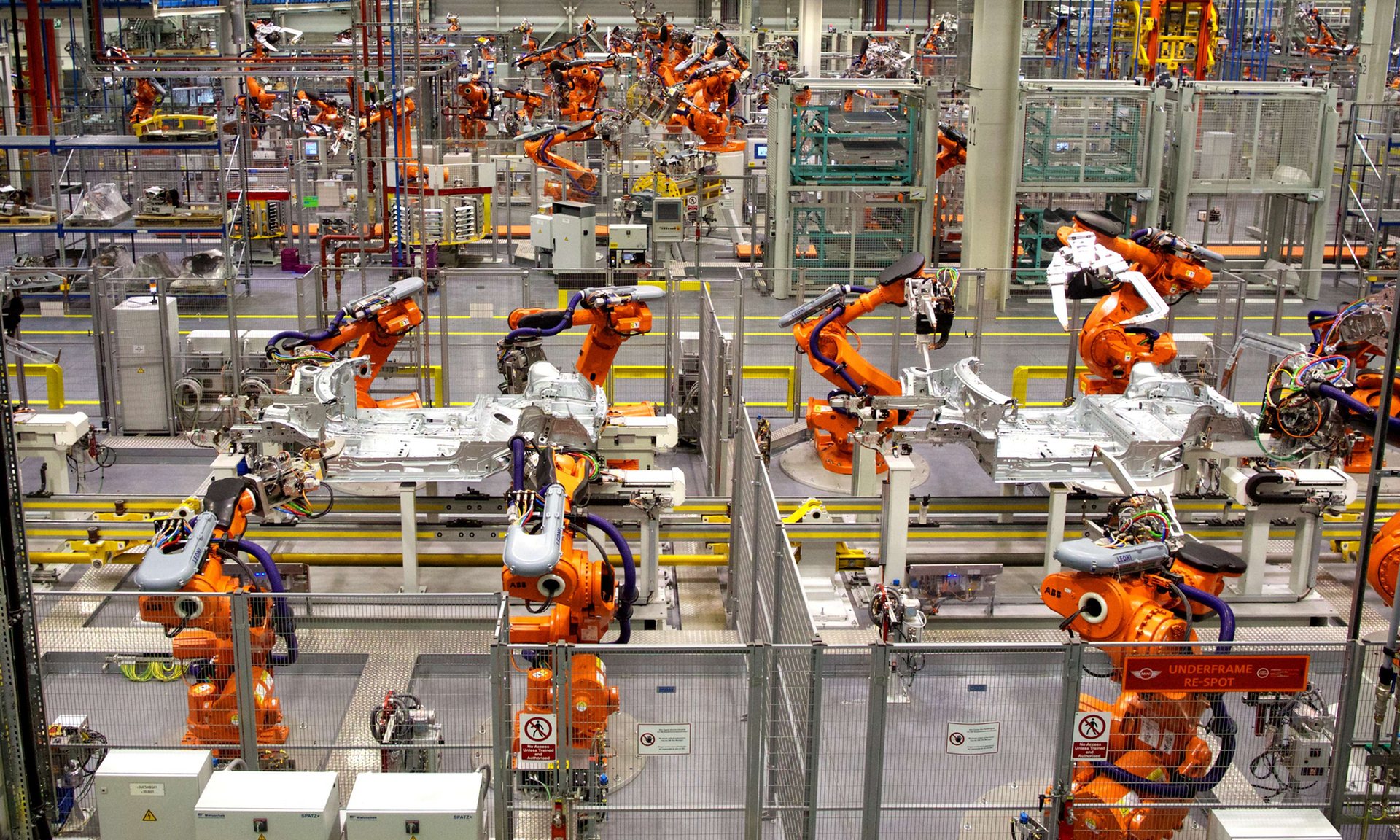

Photograph: Andrew Cowie/AFP/Getty Images

Silicon Valley vs. Wall Street

Another big tech company is trying to get into your wallet.

Google plans to offer checking accounts to customers starting next year. It’s partnering with Citigroup (C) and a credit union at Stanford University on the project.

More details: Google doesn’t plan to take centre stage on the checking accounts. Instead, the financial institutions’ brands will be put on the accounts and banks will be responsible for the financial plumbing and compliance.

Partner banks and credit unions will offer these smart checking accounts through Google Pay. Google also hasn’t decided whether the accounts will have fees. The case for banking: Google (GOOGL) already offers smart home devices and Google Assistant, and it just entered the health and wellness world with its planned acquisition of Fitbit. Banking is one big piece of the consumer puzzle that’s still missing.

But there’s no first-mover advantage: Amazon also wants to introduce checking accounts for customers. Facebook (FB) announced its Libra cryptocurrency project earlier this year. And Apple has teamed up with Goldman Sachs to launch a credit card, while its Apple Pay service has become a go-to payment method for many iPhone customers.

What to expect from Walmart

The world’s biggest retailer will report its third-quarter results before the opening bell, giving investors a fresh look at the health of US consumers.

Wall Street thinks: Walmart (WMT) is expected to report earnings per share of $1.09 on revenue of $128.1 billion, according to Briefing.com. Expectations are high: The company’s stock is trading near a record high above $120 per share.

The scene: Walmart has successfully defended its stores against Amazon and pressed its advantage with middle and lower-income shoppers across the country. To do so, it has invested heavily in lower prices, spruced up stores and grown in e-commerce.

A strong report would help convince investors that US recession fears are overblown.

Facebook shuts down 5.4 billion fake accounts

So far this year, Facebook has shut down 5.4 billion fake accounts on its main platform. That’s compared to roughly 3.3 billion fake accounts removed in the whole of 2018.The disclosure highlights the scale of the challenge before Facebook as it prepares for a high-stakes election season in the United States. On a call with reporters, CEO Mark Zuckerberg framed a large number of fake accounts that have been removed as a sign of how seriously the company is taking this issue. He called on other platforms to make similar disclosures. The huge volume of fake accounts also shows that bad actors are determined to use social media to sew discord and profit from illicit scams. The big questions: How did we design a system with so many flaws? And can social media be fixed?