The country’s annual rate of inflation increased by 10,16 percentage points to 31,01 percent in November from 20,85 percent in October as speculative price increases took toll on the economy. Analysts, however, said the figures announced yesterday are still too far for the country to enter hyperinflation zone and indications are the inflation rate will decelerate on the back of some austerity measures Government has put in place to curtail domestic spending.

The previous two months saw prices of most consumer goods and services skyrocket to levels last witnessed before dollarisation, a period that was typified by panic buying and hoarding, further pushing retail prices up.

ZimStats report released yesterday said the data on prices was collected during the period covering the five days around November 15, 2018 and the annual rate of inflation has reflected accordingly.

The year-on-year inflation rate (annual percentage change) for the month of November 2018 as measured by the all items Consumer Price Index (CPI) stood at 31,01 percent, gaining 10,16 percentage points on the October 2018 rate of 20,85 percent, highlighted latest figures from the Zimbabwe National Statistical Agency (ZimStats).

The year-on-year food and non-alcoholic beverages inflation prone to transitory shocks stood at 42,71 percent while the non-food inflation rate was 25,40 percent.

And on a monthly basis, prices increased by 9,2 percent last month compared to 16,44 percent in October.

PRESIDENTThe month-on-month food and non-alcoholic beverages inflation rate stood at 14,53 percent in November 2018, shedding 5,59 percentage points on the October 2018 rate of 20,12 percent. The month-on-month non-food inflation rate stood at 6,50 percent, shedding 8,16 percentage points on the October 2018 rate of 14,66 percent.

Other observers have attributed the quickening inflation to the continuance of the parallel currency market.

Economist Brains Muchemwa, said despite the recent increases in the rate of inflation over the last couple of months, Zimbabwe is still far from entering hyperinflation.

He expects the annual rate of inflation to decline in the future.

“As long as the Government curtails domestic M3 growth, the rate will decelerate.”

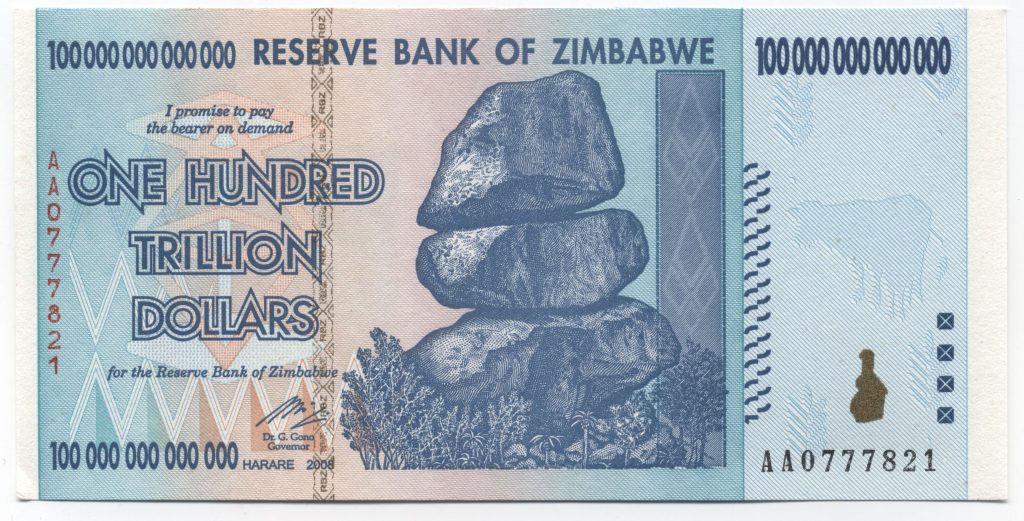

Zimbabwe uses a basket of currencies dominated by the United States dollar, as well as financial instruments — the bond notes, which are guaranteed by an international financial organisation.

Although the Reserve Bank of Zimbabwe (RBZ) has pegged and maintained the US dollar-bond note official rate at 1:1, cash shortages have resulted in a thriving black market for physical currency, both bond notes and United States dollar notes.

And it is largely expected that the high demand for US dollars by both companies and individuals continues to push up the exchange rate.

Said economic observer Dr Godfrey Kanyenze: “The festive season normally attracts high demand of foreign currency as retailers need to restock quickly, and in our current situation there is limited supply of foreign currency and the available foreign currency is being sold at a premium.”

Dr Kanyenze added that Zimbabwe should produce more to earn the required foreign currency since 60 percent of the country’s foreign currency comes from exports.

RBZ governor Dr John Mangudya has, however, said the current rise in inflation is short-term and the authorities expect the annual inflation rate to correct going forward and settle.