One week doesn’t make a market cycle. Investors who just poured almost $9 billion into U.S. equities can take comfort in that.

Not that this was such a bad one. Small-cap stocks, in particular, acquitted themselves well, even as 10-year Treasury yields soared to a seven-year high. But for most companies, the specter of rising rates was too much to bear, and the S&P 500 Index had its biggest drop since early April.

In a bull run powering through its 10th year, market timing has become an onerous task. One week stocks are climbing to reflect a stellar pace of earnings growth. The next they’re in the red as yields jump and trade talks with China stall. The cost is less to the wallet than the psyche, after two years of uninterrupted gains.

“It’s really more of a no man’s land area, is how I look at this — in other words, not definitively good or bad,” said Jason Browne, chief investment strategist at FundX Investment Group. “It’s too early to fully jump on board, for lack of better way of putting it.

Piling Into U.S. Stocks

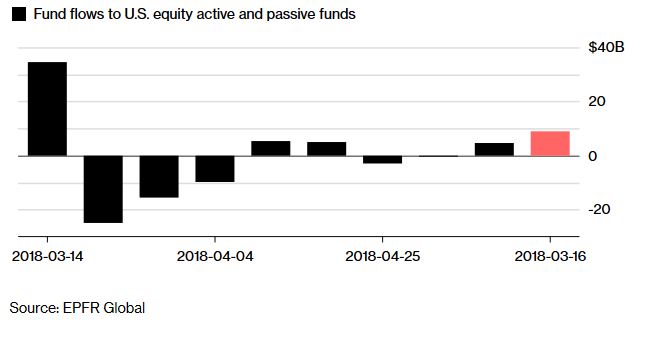

About $8.8 billion flew into U.S. equity funds in the five days ending May 16.

By any measure, the past five days were mild in comparison to February and March, when weekly losses twice ballooned past 5 percent. The toll was on sentiment, as bulls who saw an all-clear signal in last week’s 2.4 percent S&P 500 rally were again turned back.

Clouding the picture was a combination of economic and geopolitical concerns. Ten-year yields touched a seven-year high, reigniting concern that higher rates make equities less appealing. President Donald Trump’s comments doubting a successful outcome for U.S.-China trade talks sparked uncertainty over foreign sales, sending the Nasdaq 100 falling the most in a month and a half.

While large-caps stumbled, their smaller peers shone, thanks partly to an allocation away from multinationals that may be penalized by a stronger dollar. The Russell 2000 Index closed at records three times, muting pundits who see higher yields hurting smaller firms with higher levels of debt. Options traders were bullish as well: the cost of protection against a 10 percent drop in small-cap equities hovers near the lowest level since January.

“The smaller caps, more domestically oriented, will be looked on favorably by investors,” said John Toohey, head of equities at USAA Asset Management Company. “Trade too, they’re less sensitive to whatever happens on the trade tariff front.”

Whatever the reason, it’s been tough to time the market. Earlier this month, the S&P rose for four consecutive sessions, spurring investors to put $8.8 billion into U.S. equity ETFs and mutual funds in the five days through May 16, according to EPFR Global Data. That’s the biggest inflow since mid-March. The gauge fell in three out of five sessions this week, finishing the week 0.5 percent lower.

The Nasdaq 100 Index fell 1.2 percent, while the Russell 2000 Index advanced 1.2 percent.

Even as the the S&P 500 fell for the week, the market breadth kept improving, as the number of stocks reaching a 52-week high rose to the highest since late January versus the stocks that posted a 52-week low.

“The headlines are there, and they were there beforehand,” said Ernie Cecilia, the chief investment officer at Bryn Mawr Trust Co. “What’s dictating the direction of markets underlying all of that is economic growth, earnings and interest rates. That’s in our view what’s really driving the bus here.”