Egypt, prime territory for risk-hungry debt traders for the past 15 months, could be upstaged by other emerging markets as it begins to cut rates to spur the economy.

Lured by high yields, more than $20 billion from overseas have surged into short-term Egyptian local-currency debt since authorities floated the pound and secured an International Monetary Fund loan in 2016. The money has helped Egypt finance its deficit and boosted supplies of hard currency, paving the way for an economic recovery that President Abdel-Fattah El-Sisi says will vindicate reforms painful for many Egyptians.

“If yields drop enough, then Egypt’s market could be compared to Turkey, for example,” whose greater liquidity and longer history of foreign investment might swing sentiment in its favor, said Anthony Simond, who helps manage $13 billion of emerging-market debt at London-based Aberdeen Asset Management Plc. “That’s something to watch out for, but we’re not there yet.”

With inflation falling to within the central bank’s target range for the first time last month, the regulator has started reversing the tight monetary policy it presided over in 2016 and 2017. Officials shaved 1 percentage point off the benchmark interest rate in February, and economists expect additional cuts of as much as 400 basis points this year.

Sizable Exit

The yield on Egypt’s one-year T-bills began falling this year, even before interest rates were cut, as investors priced in lower returns. It’s now 1.6 percentage points below the beginning of January.

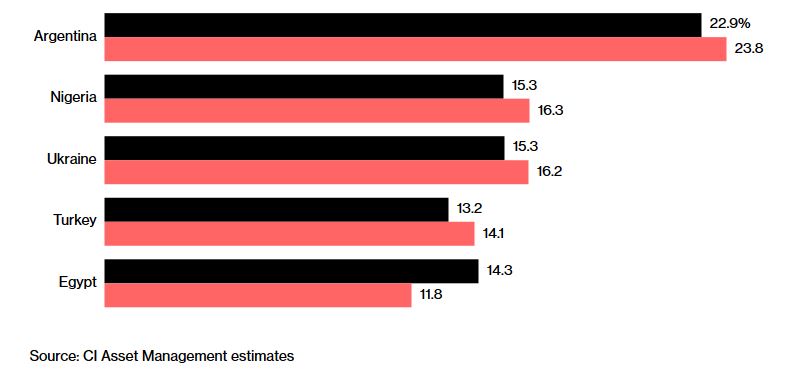

Cairo-based CI Capital Asset Management sees a 3-percentage point plunge through 2018 to 11.8 percent, it said in a report. If yields in competing countries rise by 1 percentage point in the same period, as CI Capital estimates, investors could begin to exit Egyptian debt unless authorities take precautionary measures, it said.

Losing the Edge?

Egyptian assets will shed competitiveness if yields drop following interest rate cuts

“Authorities need to ensure yields don’t fall at the same pace as rate cuts,” said CI Capital’s Noaman Khaled, who wrote the report. Ways to do that could include lowering or removing the 20 percent tax levied on foreign T-bill investors, and continued efforts by the central bank to absorb liquidity and reduce local demand for the debt.

Egyptian officials have said a drop in yields won’t necessarily mean a foreign exodus, as investors are likely to accept lower returns in exchange for an improving risk profile. Egypt is rated B3 at Moody’s Investors Service, six levels below investment grade.

Currency Gains

The improvement in the economy’s fundamentals provide room for the central bank to cut rates without seeing outflows, said Oliver Weeks, economist at London-based Emso Asset Management Limited. “But they need to be cautious.” Yields after tax “will need to remain in double digits even with much lower inflation,” he said.

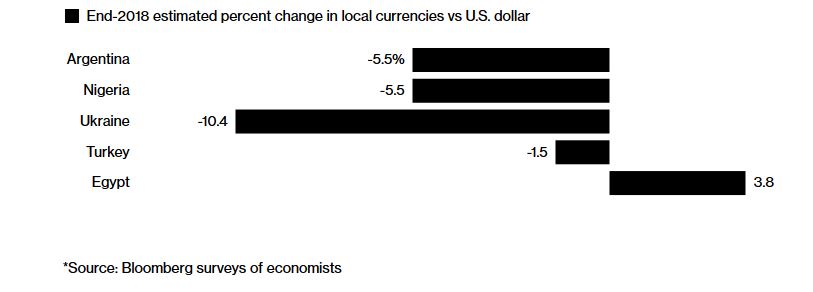

Egypt might also be buoyed by potential gains in the pound. Bloomberg surveys of economists show that, of the five countries in question, Egypt is the only one with a currency expected to appreciate by the end of 2018.

Currency Risk

Along with yields, T-bill investors also consider possible gains/losses on currencies

Aberdeen’s Simond said the pound’s direction might ultimately prove crucial.

“It’s too early to say now what we may do in six to 12 months time,” he said. “Especially since the Egyptian pound is a large part of the investment thesis.”