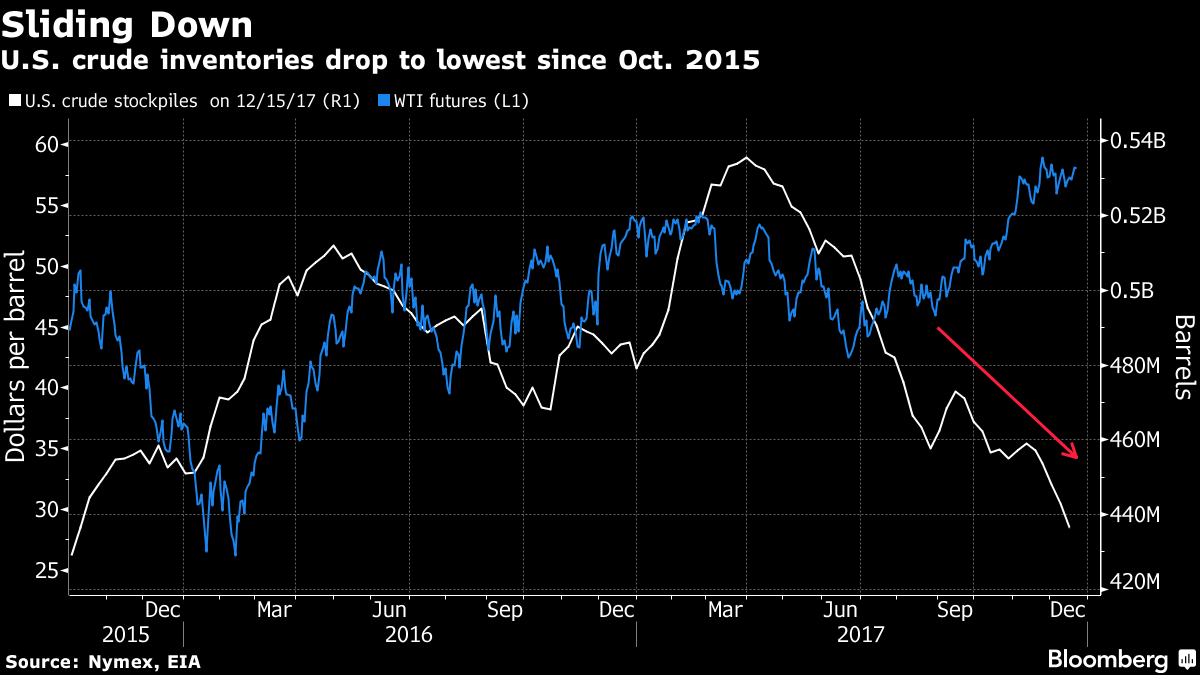

Oil traded near the highest close in more than two weeks after crude stockpiles in the world’s largest economy slid more than forecast to a two-year low.

Oil is heading for a second yearly advance after the Organization of Petroleum Exporting Countries and its allies including Russia decided to prolong production curbs through the end of 2018, with the goal of returning global stockpiles to their five-year average. Prices have also been supported after the discovery of a crack halted a critical North Sea pipeline.

West Texas Intermediate for February delivery was at $57.95 a barrel on the New York Mercantile Exchange, down 14 cents, at 9:52 a.m. in London. Total volume traded was about 49 percent below the 100-day average. The contract gained 0.9 percent to $58.09 Wednesday.

Brent for February settlement fell 26 cents to $64.30 a barrel on the London-based ICE Futures Europe exchange after adding 1.2 percent Wednesday. The global benchmark traded at a premium of $6.30 to WTI.

U.S. crude inventories slipped to 436.5 million barrels last week, while oil exports jumped by 772,000 barrels a day, the biggest increase on record, the Energy Information Administration said on Wednesday. Meanwhile, gasoline stockpiles climbed 1.24 million barrels, the smallest gain in four weeks, and distillate supplies increased by 769,000 barrels.