Workers harvest fruit from palm trees on Feronia Inc.’s Lokutu plantation.

Photographer: Tom Wilson/Bloomberg

The equatorial sun pierces the forest canopy as two laborers manipulate a machete at the end of a long pole to cut hard red fruits from the top of a soaring palm. The heavy bunches are collected by hand and trucked to a mill, where palm oil is extracted before beginning its journey down the Congo River.

The men work for the local unit of Feronia Inc., an obscure London-based company that’s taking on long odds: trying to build a business in one of the least commercially friendly countries in the world. In the Democratic Republic of Congo, a country recently torn by civil war, the goal is to revive commercial agriculture—and sell shares on the London Stock Exchange in as little as 18 months.

Photographer: Tom Wilson/Bloomberg

To succeed, Feronia must upgrade crumbling equipment, navigate Congo’s complicated business environment and manage an aging workforce of more than 7,000. In its favor, the company, which began operating under other ownership 106 years ago, has a 107,000-hectare concession with decades of expertise in palm-oil cultivation and an under-served domestic market.

“The upside potential is so much bigger than the challenge,” chief executive officer Xavier de Carniere said in London in July. If consumption of palm oil, the main cooking oil in much of Africa and parts of Asia, were to increase to just the African average, demand from Congo’s 82 million people would quadruple to 1 million tons, he said.

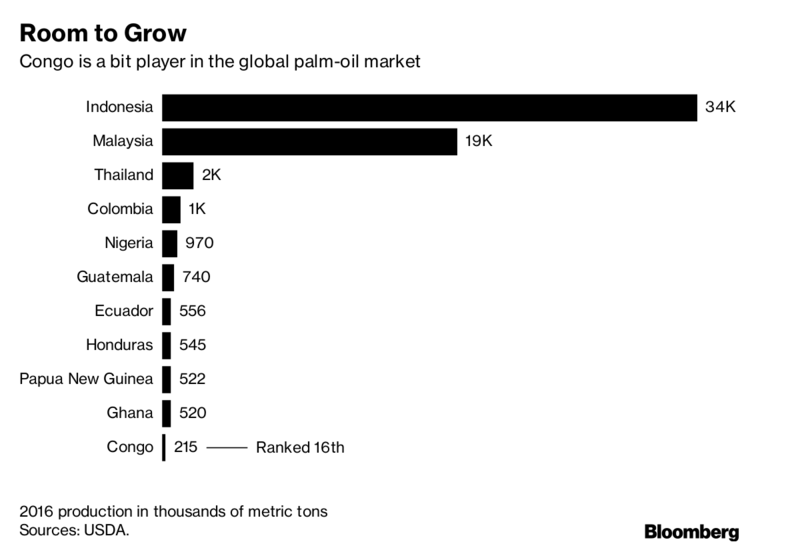

Feronia produced 20,700 tons of palm oil last year with 30,000 hectares of palm under cultivation. It plans to increase production to 100,000 tons by 2024 as those trees reach maturity. That would make it by far the biggest palm-oil producer in Congo.

But it’s still a minnow in the 67-million-ton-per-year global palm oil market. The world’s biggest producer, Wilmar International Ltd., has more than 225,000 hectares under cultivation in Malaysia and Indonesia and a further 213,000 hectares in Africa all told. Feronia says it won’t compete with producers like Wilmar or Malaysia’s Sime Darby Bhd as it won’t export. It can also avoid the environmental criticisms levied against many of the southeast Asian producers by not chopping down forests to plant palm trees, said de Carniere, 46.

Congo was one of the world’s biggest producers of palm oil when Feronia’s three plantations, then owned by the Anglo-Dutch consumer goods giant Unilever NV, were at their peak. The central African nation, two-thirds the size of Western Europe, exported over 140,000 tons of the edible oil in 1968; last year it had to import about half of the 250,000 tons its people consumed.

Unilever abandoned the plantations, founded in 1911, in the 1990s as Congo collapsed into civil war, leading to a decade of neglect. Machines rusted and workers went unpaid. Feronia, the brainchild of Canadian investor Ravi Sood, acquired the business, known as Plantations et Huileries du Congo SA, from Unilever in 2009.

The cost: Less than 3 million euros ($3.6 million) and a commitment to take on the salary and pension obligations of the 4,000 permanent employees. Sood felt it was an excellent price for a unique company that still enjoyed the benefits of Unilever’s decades of research and development.

“We bought the company that started it all, a business with 100 years of embedded expertise and operating experience,” Sood, 41, said from Toronto.

Then things got tough. Congo’s crumbling infrastructure delayed the delivery of important industrial components, palm oil prices fell and Feronia’s share price tumbled on the Toronto Stock Exchange as profitability remained elusive.

The turnaround came as De Carniere arrived in 2015 from another business with agricultural operations around Africa. Injections of equity and debt from European development finance institutions saved the finances. Feronia has replanted 16,600 hectares and rebuilt three mills. A listing in London, where other listed palm oil businesses have prospered—New Britain Palm Oil Plc, for instance, was acquired by Sime Darby in 2015 for $1.7 billion—is planned in the next year and a half.

Photographer: Tom Wilson/Bloomberg

“Both production-wise and financially we’re going to see a big turnaround in the next year,” said Edward Hugo, head of research at VSA Capital Limited, which has followed Feronia since 2014. The decision to focus on feeding the large local market may also provide the company with some protection from political interference, Hugo said.

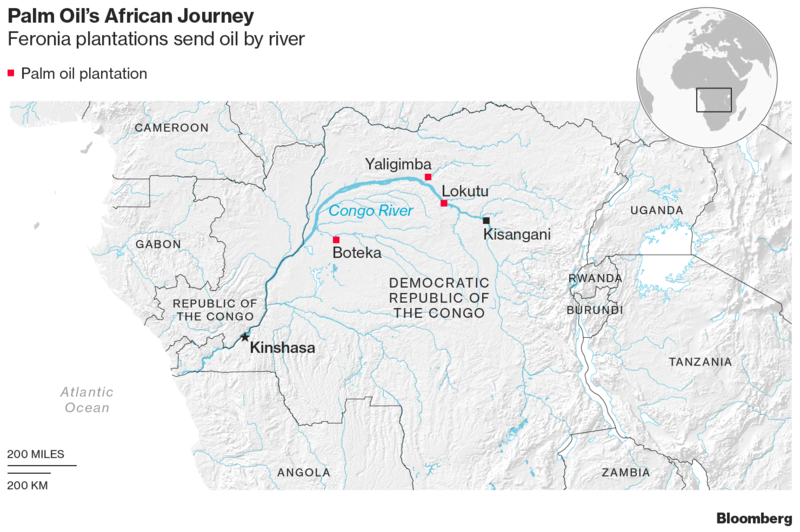

The three plantations, at Boteka, Yaligimba and Lokutu, are spread along 1,000 kilometers (621 miles) of the vast Congo River, which sweeps west from southeastern Congo, crosses the equator twice and skirts the capital of 12 million people before spilling out into the Atlantic Ocean. The river is the export route for Feronia, which ships its oil by barge to refiners in Kinshasa.

At Lokutu, 1,530 kilometers by river from Kinshasa, the white-walled, green-roofed plantation houses appear little changed since Unilever left. Only the shell of a tennis court and an empty, overgrown swimming pool suggest a grander past.

Between 1998 and 2003, with the country divided and the war raging, the business was cut off from Kinshasa and salaries were frequently unpaid. A loyal workforce kept operations going, according to Raymond Batanga, who joined the company, known by its initials of PHC, in 1976 at the age of 25. “The workers knew this was their jewel,” he said.

Now Feronia’s chief operating officer, Batanga said the plantations remain the most important economic actors in a vast region: “Without this plantation there is no life for more than 100 kilometers around, no ability to buy clothes, to buy salt,” he said of Lokutu. Even today PHC remains Congo’s second-biggest employer, with 3,800 permanent staff and at least 4,000 temporary workers.

Outside a general store at Lokutu, Logos, 25, and Masadi, 30, loaded six 20-kilogram (44-pound) kg bags of salt onto two rusted bicycles for their return journey to Djolu, 200 kilometers west. The round trip to the PHC shop was their best option to buy salt, they said.

Photographer: Tom Wilson/Bloomberg

The story of agricultural decay before Feronia arrived is common in Congo. The giant country has around 80 million hectares of arable land, with the potential to feed more than a billion people, but less than 10 million hectares are under cultivation, according to USAID. Decades of conflict and under-investment in infrastructure have seen domestic transport costs increase, imports rise and large-scale agriculture almost disappear.

As a result, at least 50 plantations are currently for sale in the country, according to Feronia, which would consider another acquisition if it succeeds with PHC.

“The conditions should be right for people to make successful agricultural businesses in the DRC, not least because Kinshasa is one of the biggest cities on the planet and requires feeding,” said David Easton, investment director at the U.K. development finance institution CDC Group Plc. “We hope that being able to demonstrate that would bring other investors into the sector.”

CDC owns 68 percent of Feronia, while other European agencies and the African Development Bank own 26 percent through the African Agriculture Fund. The Belgian, German and Dutch governments provided a further $25 million in loans in 2016 and 2017.

By rehabilitating an old plantation, Feronia has achieved production without any deforestation, a key requirement for the U.K. government that could see it stick with the company for the long-term, Easton said. “Once you’ve built the team that is capable of doing that in tough parts of Africa, that’s quite a valuable asset.”

— With assistance by Samuel Dodge