Chocolate addicts, it’s probably a good time to start stocking up. The treats may not be this cheap much longer.

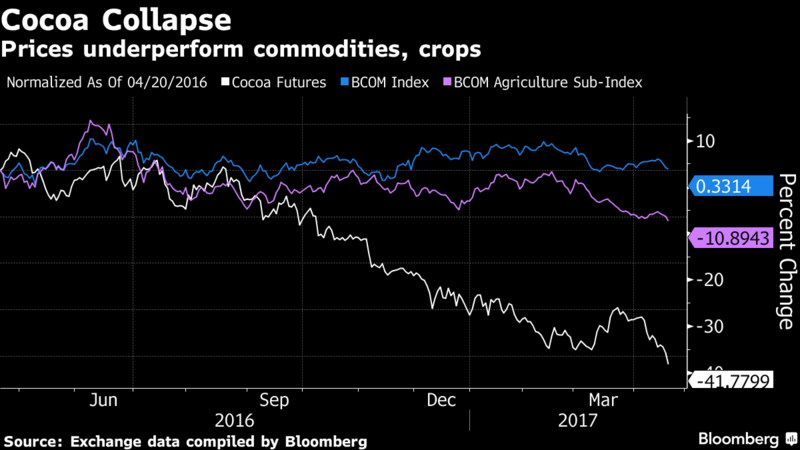

Cocoa’s 41 percent slump over the last 12 months makes it the worst performer among 34 commodities tracked by Bloomberg. Prices tumbled as output increased in Ivory Coast, the world’s top grower, and the decline has pushed down retail prices for chocolates.

But buyers are finally snapping up inexpensive supplies, and seven out of nine traders surveyed by Bloomberg expect prices will rebound by year end. Bean grinding, a measure of demand, has been on the rise this year, while hedge funds have started paring their bearish bets on futures. The slump also may force farmers to cut investments, eroding crop yields.

“Commodity prices typically don’t stay very low for a long time,” John Stephenson, chief executive officer of Stephenson & Co. Capital Management, which oversees $45 billion, said by phone from Toronto. “We should see better consumer demand. Prices are due for a nice bounce.”

Cocoa dropped 14 percent this year to $1,826 a metric ton as of 10:32 a.m. on ICE Futures U.S. in New York. Prices reached $1,756 this week, the lowest since August 2007. On Friday, they jumped as much as 3.1 percent.

‘Panic’ Selling

A dramatic plunge Thursday sent futures down as much as 6.2 percent, the biggest such loss since 2012. The move was driven by technical selling, according to analysts and traders. The drop was “not justified, but just part of the panic associated with the making of final lows,” Shawn Hackett, president of Hackett Financial Advisors in Boynton Beach, Florida, said by email.

Prices will rebound to $2,353 by the end of the year, according to the average of nine estimates in a Bloomberg survey. The reversal would mean a jump of 31 percent from Thursday’s closing price.

Money mangers reduced their bearish cocoa holdings in four of the past five weeks. The speculators had a net-short position, or the difference between bets on a price decline and wagers on a rise, of 22,437 futures and options as of April 11, the most recent U.S. government data show. That compares with a record 32,704 reached a month earlier.

Lower prices are allowing chocolatiers to increase serving sizes, or boost the amount of cocoa going into confections, said Paul Kortenkamp, a Los Angeles-based vice president for broker McKeany-Flavell Co. He previously worked for Barry Callebaut Group and Blommer Chocolate Co., two of the world’s largest processors. That’s a turnaround from the recent trend and increases the amount of beans used.

Quality Issues

While Ivory Coast farmers are expected to collect a record harvest, usable supplies could be more limited. In March, Bloomberg News reported that at least four cocoa exporters in the West African country rejected beans arriving at port warehouses because of quality issues.

Those problems could be exacerbated by the recent rout. In late March, Ivory Coast cut the price paid to cocoa farmers by 36 percent. Falling prices could spur growers to pick fewer pods and reduce field husbandry, according to Rotterdam-based trading firm Cocoanect BV. The slump also raises the risk of unrest as farmer incomes drop, heightening the threat to the domestic economy.

The stability of West Africa, which accounts for about 70 percent of global production, is a key driver for the market. In March 2011, cocoa surged to the highest in 32 years after an election dispute led to civil war. Concerns that an Ebola outbreak would disrupt trade drove a temporary price spike in 2014.

Buyers are stepping in to grab supplies before they get more expensive. Cocoa grindings in Asia jumped 19 percent in the first quarter from a year earlier, the Singapore-based Cocoa Association of Asia said Thursday. That topped analyst estimates for a gain of 10 percent. Processing in Europe climbed 1.1 percent in the period, and rose about 1 percent in North America.

Grinding Record

Global grindings are expected to reach 4.242 million tons in the 12-month period that ends Sept. 30, according to the International Cocoa Organization. That would be the second-highest since the data begins in 1960, Michael Segal, a consultant for the group, said by email.

Sales of chocolate globally reached $98.2 billion in 2016, the highest on record even as volume slid by 0.2 percent from year earlier to 6.87 million tons, according to data from Euromonitor International. By 2021, sales will rise to 7.33 million tons fetching $110 billion, the researcher projects.

Still, even as demand climbs, supplies are forecast to be even bigger. The ICCO projects a global surplus of 264,000 tons this season, the largest in six years. Other forecasters have pegged the overhang at or above 300,000 tons.

Some chocolate consumption has also tempered in recent years amid changing consumer habits as more people seek healthier snack options. The trend has become more acute in the countries with the highest per capita consumption, including the U.K., Germany, Austria, Russia and even Switzerland, famous for its high-quality treats, according to researcher Mintel.

“Without the support of civil war or Ebola, if the funds decide to increase shorts, prices could be heading for another sell-off,” Jason Estrada, senior trader with INTL FCStone in Miami, said in a telephone interview.