Ivory Coast’s cocoa regulator pointed to speculators and prospects for a glut as the reason for a slump in futures that forced the nation to cut the price it pays farmers. There was something it didn’t blame: Itself.

Le Conseil du Cafe-Cacao also said a volatile pound and defaults by local exporters contributed to a plunge in international futures. But there’s frustration that the CCC’s slow response to the crisis gave speculators more reason to short prices, on expectations that beans would have to be resold at a time the market was forecast to return to surplus.

There was a “lack of response from Ivory Coast,” said Youssouf Carius, an economist based in the commercial capital, Abidjan. “When the market was expecting some answers, the CCC said nothing. Everybody ignored the crisis that was looming.”

As London futures tumbled toward the end of last year, many of the hundreds of exporters that had bet on higher prices were forced to default on their contracts. With fewer buyers, beans started to pile up in the country, helping push prices even lower. The problem left the state facing losses of more than $300 million and prompted it on Thursday to cut the minimum price it pays farmers for the smaller of two annual crops starting next month by 36 percent.

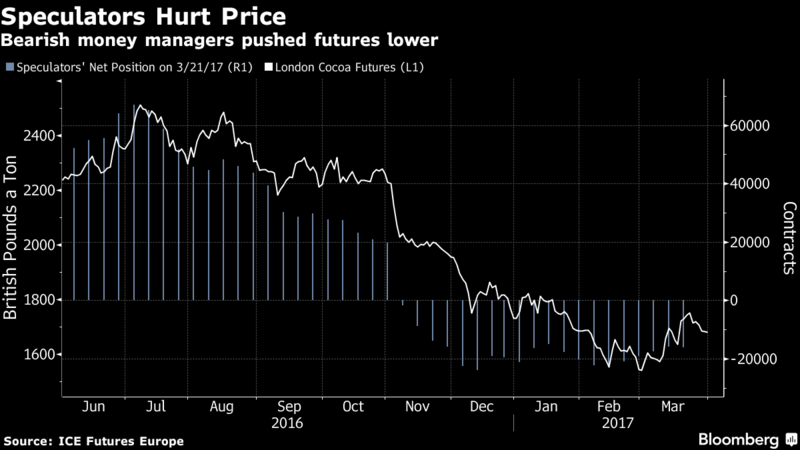

The country first warned about exporter defaults in September. While it deliberated over whether to cancel contracts, money managers began selling, and by early November they were betting on lower London futures for the first time since 2012.

Cocoa futures slipped for a fifth day on Monday, losing 0.7 percent to 1,667 pounds ($2,083) as of 10:18 a.m. in London.

The regulator says coffee is partly to blame. Speculators pulled out of cocoa and bought the other bean due to uncertainty over coffee crops in Brazil, CCC President Lambert Kouassi Konan said in Abidjan Thursday, as he explained to farmers, traders and the media why Ivory Coast lowered the farmgate price.

Konan also said reduced demand and too much supply contributed to cocoa’s slump. In addition, he mentioned swings in the pound because of Brexit as another reason, without elaborating.

Many shippers defaulted because the CCC didn’t properly monitor exporters speculating on prices, said Alexandre Andrey, an analyst at BMI Research, a unit of Fitch Ratings Ltd.

Cocoa Middlemen

Shippers, as well as middlemen who benefited from offering growers less than the minimum rate set by the state, are also responsible for the crisis, CCC Managing Director Massandje Toure-Litse said. The country may have to consider adopting a similar system to that in No. 2 producer Ghana, where a state-controlled board is responsible for buying cocoa from farmers, she said.

The new farmer price of 700 CFA francs ($1.14) a kilogram is the lowest since the country reformed the industry in 2012. It’s also about 60 percent of current international rates.

“Producers may be dissatisfied with the price,” the CCC’s Konan said. “But they shouldn’t protest, as it may be seen as disruption to the public order.”

Farmers at the meeting suggested Ivory Coast needs to produce forecasts for the harvest and be more transparent about plans to stabilize the market. The CCC didn’t answer questions about how much money is held in funds designed to mitigate market risks and support prices for farmers. It also didn’t say how much of the crop has already been sold.

Toure-Litse declined to answer further questions when approached by Bloomberg at the end of the meeting.

“The situation is difficult,” Konan said. “But it’s not the president that sets the price, it’s the market.”