Ghana’s new finance minister faces having to fulfill election pledges to spend more on education and job creation while trying to raise investor confidence eroded by fears about the nation’s finances.

After promises of free high-school education and tax cuts in the run-up to a December vote, Finance Minister Ken Ofori-Atta, 57, will present the 2017 budget on Thursday following last month’s discovery of about 7 billion cedis ($1.5 billion) in unplanned spending by the previous administration. That startled markets, weakening the cedi and raising bond yields.

Ghana’s budget deficit was 10.2 percent of gross domestic product last year, almost double the government’s forecast, after the public-finance hole deepened the existing gap caused by lower income from cocoa and oil exports. Options to fund the election promises are limited, with spending that excludes debt-service costs exceeding state revenue in the world’s second-biggest cocoa producer in 2016. It’s also relying on an almost $1 billion International Monetary Fund program to prop up its finances.

“The new government clearly faces the dilemma of allaying investor fears while finding funds to promote the private sector at home,” Simon Quijano-Evans, an emerging-market strategist at Legal & General Group Plc in London, with $1 billion emerging fixed-income assets under management, said by phone. “Finding the balance” would go a long way in restoring confidence, he said, declining to disclose if L&G holds Ghanaian bonds.

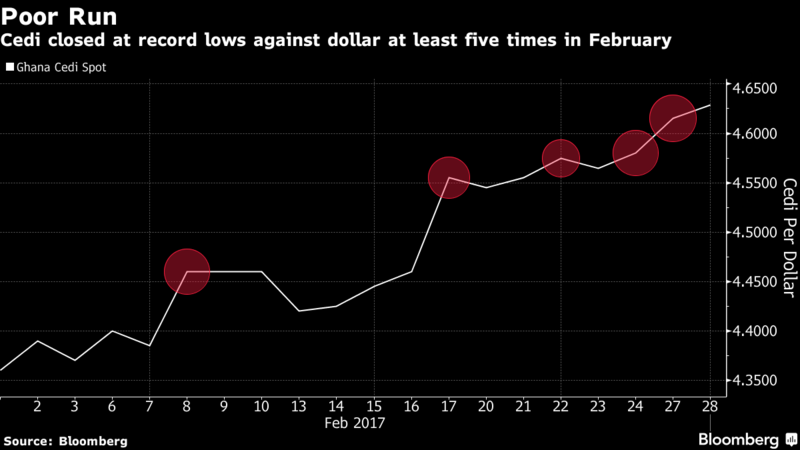

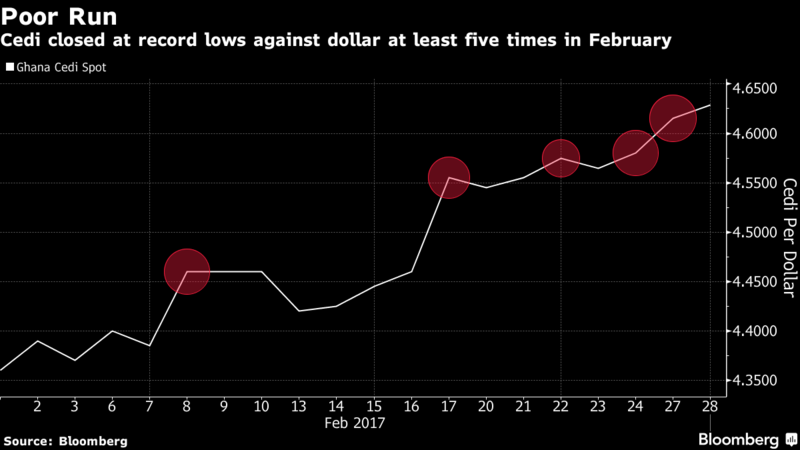

Cedi Decline

The cedi fell to record lows throughout February. It gained 1 percent to 4.65 against the dollar at 8 a.m. in Accra, paring the drop this year to 6 percent and making it the world’s worst performer this year after Sierra Leone and Democratic Republic of Congo’s currencies. Its greenback-denominated debt returned the least among African peers in the month.

Ofori-Atta said last month the government of West Africa’s biggest economy after Nigeria, led by the New Patriotic Party, will announce tax breaks and other measures to support the private sector and help boost the economy that last year probably expanded at the slowest since 1990.

Among the NPP’s promises is a plan to spend 560 million cedis to employ some 250,000 farmers to grow crops starting this month. Free high-school education will kick in when the new academic year starts in September. President Nana Akufo-Addo wants to set up one factory in each of the nation’s 216 districts and provide $1 million to every one of the 270 parliamentary constituencies for development.

Funding Options

The headache Ofori-Atta faces is how to fund the pledges. The nation’s public debt stock stood at 122 billion cedis, or 74 percent of GDP in 2016, Akufo-Addo said on Feb. 21. With the primary balance on the budget being negative last year, this implies that one of Africa’s newest oil exporters is borrowing to pay down interest on its debt, Ofori-Atta said.

Investors will need to see stronger efforts at narrowing the deficit, which would support the cedi, curb borrowing costs and address debt-sustainability concerns, Kevin Daly, portfolio manager who helps oversee $11 billion emerging-market assets at Aberdeen Asset Management Plc in London, said by phone.

Ghana’s economy will grow 7.4 percent this year and 8.4 percent next year, according to the IMF.

“They will want to follow through on election promises to cut taxes, but they will also need to demonstrate to the market they are serious about addressing an unsustainable fiscal deficit,” Aberdeen’s Daly said. “It has to be a meaningful reduction over the next three years. Time is of the essence and they will have to deliver sooner rather than later.”