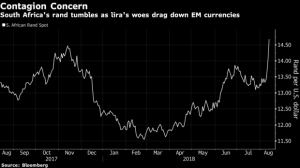

A plunge in the South African rand and a slump in the Mexican peso were symptoms of the growing contagion in emerging-market currencies Monday as the financial turmoil in Turkey sapped demand for developing-nation assets.

The MSCI Emerging Markets Currency Index fell to the lowest level in more than a year as Turkey’s lira tumbled for a fourth day after President Recep Tayyip Erdogan showed no signs of backing down in a standoff with the U.S. administration., deepening the concern that the country is sliding toward a full-blown financial crisis.

The lira’s slide “may fuel volatility in emerging-market assets and dampen investor sentiment in the near term, as markets are already skittish,” said Kerry Craig, global market strategist at J.P. Morgan Asset Management in Melbourne. “But the drivers of the lira’s decline are very specific to Turkey -– therefore it should not derail the positive fundamentals in other emerging markets over a longer term.”

Losses in the lira were pared in early European trading after Turkey’s central bank announced a list of measures, which it says will support financial stability and proper functioning of markets. The steps included a cut to bank’s reserve requirements in a bid to boost liquidity.

Investors were already cautious about emerging markets as the prospect of a global trade war compounded concerns about a more hawkish Federal Reserve and European Central Bank. In South Africa, uncertainty about the ruling party’s policies on land and mining has also contributed to the rand slumping 14 percent against the dollar this year.

The rand was 1.7 percent lower at 14.3315 per dollar as of 7:26 a.m. in London, after sliding as much as 9.4 percent, the most since 2008. Mexico’s peso was down 1.2 percent, the biggest loss in emerging markets after the lira and the rand.

“The rand should continue to be influenced by the Turkish lira crisis through the sentiment channel,” Societe Generale SA strategist Jason Daw wrote in a research note. “Until the lira stabilizes, the prospects for the South African currency are not encouraging.”

Emerging Asian foreign-exchange markets were also hit, though to a lesser degree. India’s rupee dropped to a new record low, while the Indonesian rupiah slumped 0.9 percent.

Healthy foreign-exchange reserves and robust fundamentals mean Asia’s emerging economies are in a strong position to withstand any external shocks, said Trinh Nguyen, a senior economist for emerging-market Asia at Natixis Asia Ltd. in Hong Kong.

— With assistance by Enda Curran