Cocoa prices have surged by a third this year, but that’s still unlikely to translate into big gains for farmers in top producer Ivory Coast.

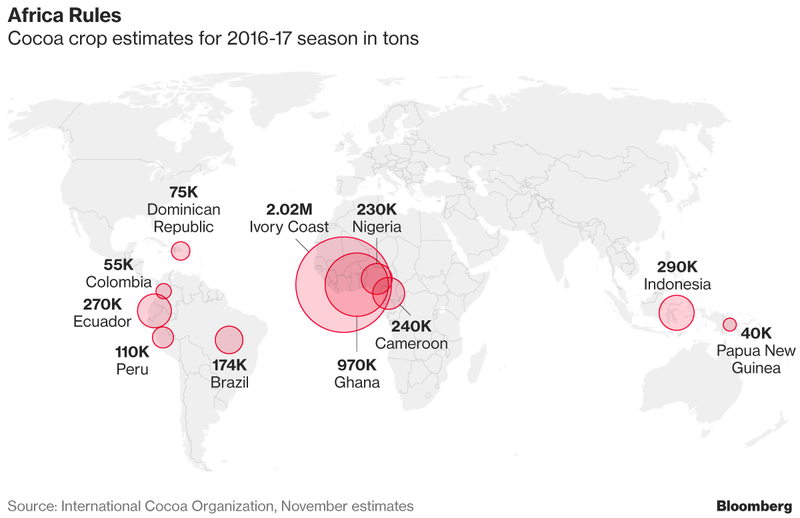

Ivory Coast and neighboring Ghana, the No. 2 producer, plan to start setting producer prices together from the next annual harvest that starts in October.

The case for holding:

The most likely outcome is for the government to keep the price stable, at about 700 CFA francs ($1.30) a kilogram, especially after last year’s crisis, said Stephen Yeboah, a researcher at the University of Lausanne and co-founder of Commodity Monitor, which studies commodities in Africa.

The regulator is auctioning a further 150,000 metric tons of mid-crop beans after previous sales for 300,000 tons, according to people familiar with the matter. The cocoa regulator and budget ministry forecast production of 450,000 to 500,000 tons, people familiar said last week.

Any price cut would put Ouattara’s popularity at risk at the time when divisions are rising within the ruling coalition, said Adeline Van Houtte, research analyst at the Economist Intelligence Unit.

The case for raising:

Prices have surged 32 percent in London this year, amid uncertainty over West African crops following some dryness earlier this year, and as demand for chocolate expands.

That could provide some leeway to raise the price, which was set after last year’s crisis prompted the government to slash the rate by more than a third, to the lowest since 2012, for last season’s mid-crop. It kept the price steady in October for the main crop harvest that will end this month.

“Political pressure will come from various levels,” the EIU’s Van Houtte said. “By keeping low prices, Ouattara risks frustrating farmers and this would affect his popularity clout that he has built by maintaining relative stability in the country.” she said. “He needs to keep this image especially ahead of the elections and as he is preparing his succession.”

The case for cutting:

Given the fact that beans from the mid-crop tend to be lower quality, combined with uncertainty about what will happen to global prices, it may make sense to reduce farmer rates further, said Edward George, head of research at Ecobank Transnational Inc.

“We’ve seen cocoa prices strengthen,” he said. “The fact is they can easily go back down again.”

How’s the crop looking?

Farmers have reported good weather across cocoa-producing areas in recent weeks, with big showers every few days mixing with sun, helping flowers to bloom and develop into pods.

Harvesting probably won’t start until late April or early May because there are currently mostly small pods on the trees, Narcisse Konan, who heads a cooperative in southwest Ivory Coast, near the town of Meagui, said last week.

“Things are looking good,” he said. “There’s been good rains for the past month.”

— With assistance by Baudelaire Mieu