AN advisor to government on the Ease of Doing Business, Ashok Chakravarti, has called for an investigation into the externalisation of funds, as it has emerged that US$5 billion could have been siphoned out of the country since dollarisation in 2009.

Speaking at the Special Policy Dialogue Forum on the quest for political and economic reform in Zimbabwe last night, Chakravarti said there is need to look into the externalisation of funds from the country.

“There is need to be an inquiry into what has been happening in the last few years,” Chakravarti said. “So many resources have gone out of the country. It cannot just be swept under the carpet. It has to be looked at carefully and addressed.”

Chakravarti also spoke of the need for the country to open up on investment, saying it was “pathetic” that the country received a paltry US$319 million in foreign direct inflows last year.

Mavambo/Kusile/Dawn leader Simba Makoni said there is need to provide a platform for a national conversation on the future of the country which did not take place at Independence.

Chakravarti and Makoni’s remarks come amid revelations that President Emmerson Mnangagwa’s administration believes close to US$5 billion was externalised via official means since dollarisation in 2009. There are reports that several Zimbabwe Stock Exchange-listed companies and diamond mining companies played a major role in siphoning money out of the country.

A source in the financial sector said: “The stock exchange-listed companies siphoned the money as management fees paid to their offshore accounts via official means.”

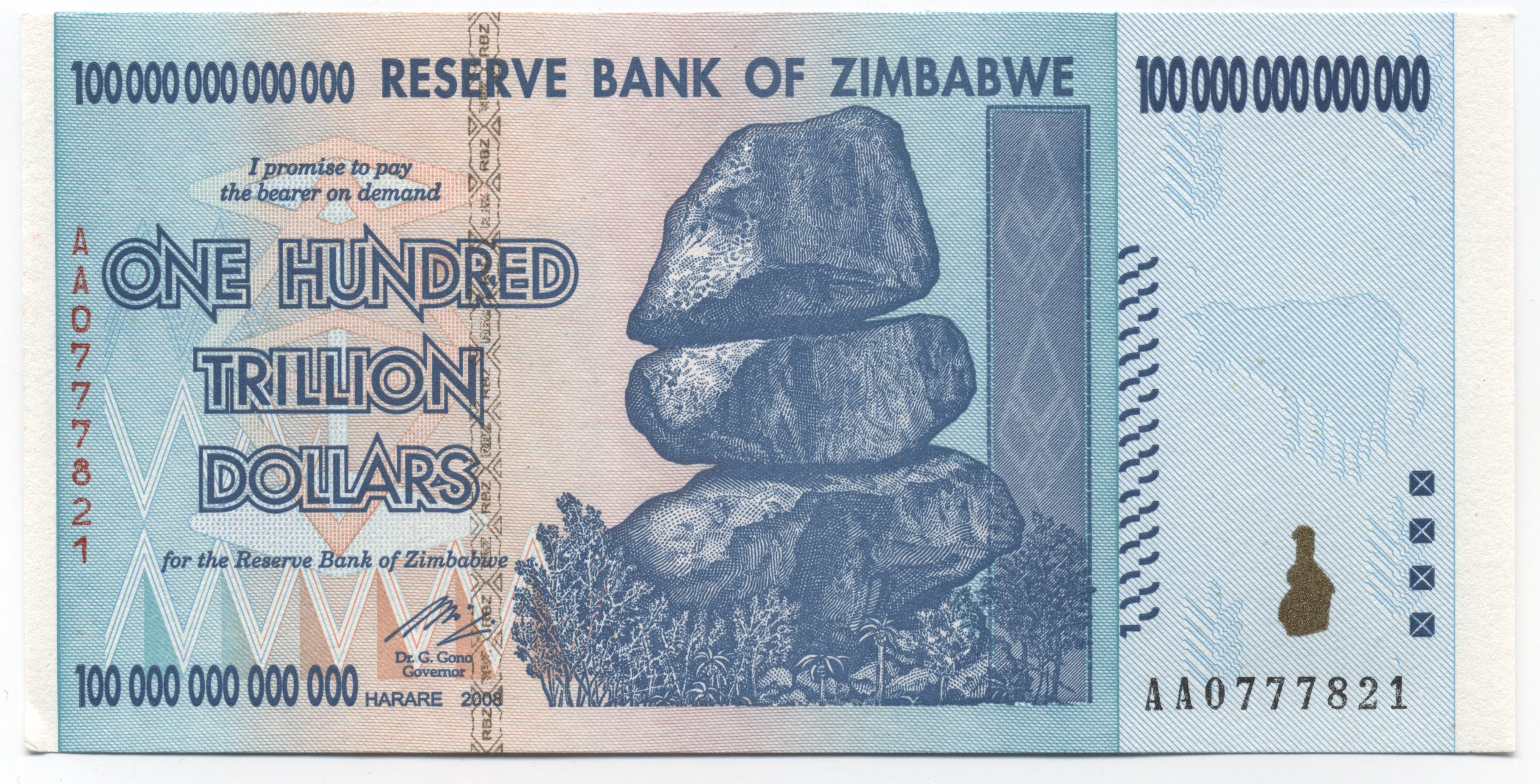

“In most cases the amounts were so big and suspicious such that they would force foreign central banks to notify the Reserve Bank of Zimbabwe (RBZ) of payments in case the money was laundered. So the RBZ has a record of all the transactions and the actual amounts that were deposited in offshore accounts.”

The money was taken out with the RBZ’s approval, but the equipment was never delivered. The companies failed to provide the bill of lading to the RBZ upon request.

This week, Mnangagwa granted a three-month moratorium within which individuals and corporates that externalised money and assets are expected to bring them back. During the period, government will neither ask questions nor prefer charges against those that will be repatriating back the money or assets.

Sources said Finance minister Patrick Chinamasa in June this year appointed a probe team to investigate and identify individuals and companies involved in externalising foreign currency from Zimbabwe. Chinamasa was, however, stopped in his tracks when former president Robert Mugabe reshuffled his cabinet, demoting him to the less influential Cyber Security ministry.

“When Chinamasa was moved from the ministry he had names of individuals and corporates that are fingered in the externalisation scandal,” a source close to Mnangagwa said. “Many of the corporates were involved in the diamond mining industry in Chiadzwa,” said the source, adding: “Companies such as the Diamond Mining Company, fronted by well-known smugglers and connected to former first lady Grace Mugabe, externalised huge amounts.”

As first reported by the Zimbabwe Independent, other diamond-mining companies like Anjin Investments, a joint venture between the Anhui Foreign Economic Construction (Group) Co Ltd (Afecc), and Matt Bronze Enterprises — a front for the Defence ministry and the Zimbabwe Defence Forces through Glass Finish Investments (Pvt) Ltd — also siphoned millions of dollars to offshore accounts. Anjin formed a subsidiary company, Sogecoa Zimbabwe Ltd, which was used as a conduit to siphon millions of dollars outside Zimbabwe.

Last year, Afecc was dragged to court on allegations of having externalised close to US$500 million. The company then paid about US$50 million to Sogecoa. A local bank acted as a conduit to wire the money out of Zimbabwe through Botswana banks.

The bank account was opened on January 3 2013, with US$50 million, but the company transferred US$40 million to Sogecoa Zimbabwe days later before transferring another US$4 million to the same company on January 10 2013. On January 17 2013, Jinan transferred another US$2,9 million to Sogecoa Zimbabwe.

The money was externalised on the pretext that Afecc was investing in equipment. Jinan deputy general manager Tapiwa Goronga told the Parliamentary Portfolio Committee on Youth, Indigenisation and Economic Empowerment, chaired by Zanu-PF MP for Gokwe-Nembudziya Justice Mayor Wadyajena, that the matter was under investigation by the police Serious Frauds Section.

Last year, the Reserve Bank of Zimbabwe (RBZ) announced stringent measures which include capping cash withdrawals without one-day prior notice to US$10 000, restrictions on offshore investment and suspending free funds to tackle illicit money flows and capital flight remittances after nearly US$2 billion evaporated from the capital-starved economy through externalization. Announcing the Monetary Policy Statement (MPS), RBZ governor John Mangudya said the apex bank would implement prudential measures, which will come into force to mitigate illicit financial flows currently hemorrhaging the economy.

He said out of the US$1,8 billion externalised in 2015, US$1,2 billion was siphoned out by corporates with outward individual remittances accounting for the balance. He added that government will operationalise an economic crimes court to plug revenue leakage.