Nigeria’s central bank left its main lending rate unchanged for a sixth consecutive meeting as it seeks to hold on to gains it’s made in inflation and exchange-rate stability.

The Monetary Policy Committee held the key policy rate at 14 percent, Central Bank of Nigeria Governor Godwin Emefiele told reporters on Tuesday in the capital, Abuja. That was in line with the forecast of all but two of 19 economists in a Bloomberg survey.

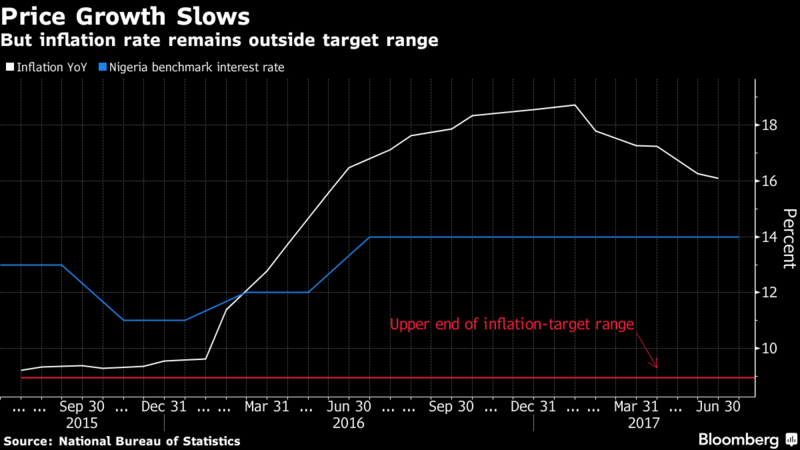

While inflation in Africa’s most-populous nation slowed to 16.1 percent in June, it remained well outside the government’s 6 percent to 9 percent target range. That, and the need for a stable exchange rate, limited room for loosening policy even as Nigeria contracted for the fifth consecutive quarter in the three months through March.

The MPC is concerned about food-price pressure and is hopeful that inflation will ease in the third quarter as the harvest starts, Emefiele said. While easing policy would signal sensitivity to economic growth, it may put pressure on the naira and discourage foreign-exchange inflows, he said.

“They are more likely to hold over short term, hiking is no longer on table,” Yvonne Mhango, a Johannesburg-based economist at Renaissance Capital, said by phone. “Although growth is fragile, easing could come later because they don’t want to undermine foreign-exchange stability.”

The central bank sold $1.5 billion of foreign exchange in June compared with $985 million in May, according to Lagos-based trading platform FMDQ OTC Securities Exchange. The bank has sold $6.5 billion since February, when it increased interventions to prop up the naira.

The MPC is satisfied with signs of improved investment inflows, Emefiele said. Better foreign-exchange management will help the sustainability of the economy’s fragile recovery, he said.

Keeping borrowing costs unchanged could help attract flows into the so-called Nafex currency-trading market, which the central bank set up for foreigners in late April to try to end a crippling shortage of dollars. The naira gained 0.6 percent to 318.48 per dollar in the official market at 7:30 a.m. in Abuja. It’s at 366.91 in the new window, about the same level as on the black market.

Six out of eight MPC members at the meeting voted to keep the rate unchanged and the rest favored a cut, Emefiele said.

“The fact that two members voted for monetary policy rate easing suggests that perhaps, before the end of the year, they might start considering easing a bit,” Omotola Abimbola, an analyst at Afrinvest West Africa Ltd., said by phone from Lagos. “We think an inflation rate of 12 percent or below will probably be one that will interest them to ease.”

— With assistance by Simbarashe Gumbo, Dulue Mbachu, Emele Onu, and Tope Alake