South African President Jacob Zuma’s order for Finance Minister Pravin Gordhan to cancel an investor roadshow in London and the U.S. left the nation’s credibility in tatters.

The rand plunged more than any other major currency after Zuma, 74, told Gordhan to return home a day after he departed for the week of meetings. The Presidency gave no reason for calling off the trip, which the Treasury said had prior approval, and the ruling African National Congress said it hadn’t received prior notice of the decision.

“It’s obviously going to be interpreted very negatively by the markets unless we are able to explain in a compelling manner, which I think is difficult by the way, why such a roadshow was cancelled,” Martin Kingston, chief executive officer in South Africa of NM Rothschild & Sons Ltd., said by phone from Johannesburg.

Speculation that Gordhan is on the verge of being fired has swirled for months, as he clashed with Zuma over the management of state companies and the national tax agency. While Gordhan has led efforts to keep spending in check and fend off a junk credit rating, Zuma wants to embark on “radical economic transformation” that he says will tackle racial inequality and widespread poverty.

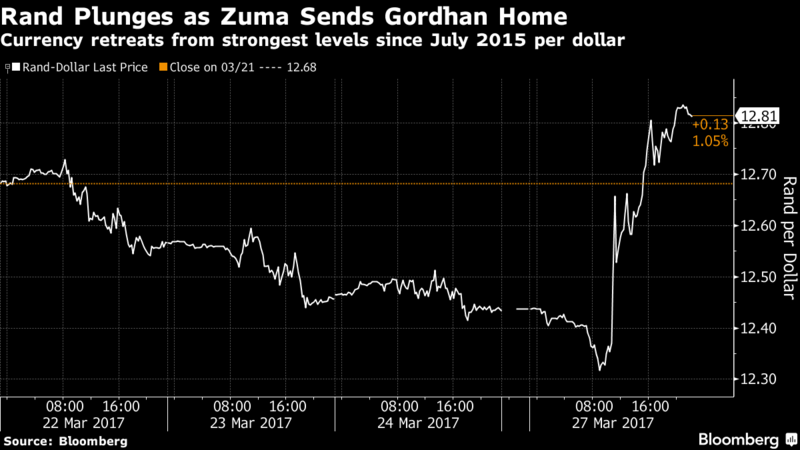

Rand Weakens

The rand weakened the most since Nov. 10, dropping 3.1 percent against the dollar to 12.8160 at 10:18 p.m. in Johannesburg. The government’s rand-denominated bonds due 2026 fell, driving the yield 33 basis points higher to 8.7 percent, the biggest jump since October.

If Gordhan or his deputy, Mcebisi Jonas, are fired, “the selloff will be vigorous,” said Jonathan Hertz, chief executive officer of Peregrine Holdings Ltd., which has 105 billion rand in assets under management. “There will be a shudder in the market. I think you could see 14.”

Zuma made his move as Sahara Computers, owned by the Guptas, who’re friends of the president, filed an application demanding that Gordhan be present in court on Tuesday for a hearing. The case is to determine whether the minister can be forced to order banks to reopen bank accounts of companies associated with the family. Gordhan asked for the state attorney to appear for him.

“The damage to investor sentiment to South Africa as a result of the president’s decision should not be underestimated,” Business Leadership South Africa said in a statement. “Coming in the middle of meetings where business and the National Treasury have been making the case for South Africa, this action has pulled the rug from under our feet.”

Zuma named Gordhan, 67, finance minister in December 2015 after his decision to install a then little-known lawmaker to replace the respected Nhlanhla Nene, which became known as “Nenegate,” hammered the nation’s bonds and currency and spurred ANC and business leaders to plead with him to reconsider.

Vigorous Selloff

“This is breaking down the relationship of trust between the government and social partners, especially because of all the lies we hear,” Dennis George, president of the Federation of Unions of South Africa, the country’s second-biggest labor group, said by phone. “It is disappointing considering all the lies from Nenegate, and it damages the credibility of the South African government.”

Moody’s Investors Service, which rates South Africa’s debt at two levels above junk and with a negative outlook, is scheduled to publish a review of the nation’s creditworthiness on April 7. S&P Global Ratings and Fitch Ratings Ltd. kept their assessments at the lowest investment grade late last year.

“This action by the presidency rolls back the progress we have made as a country,” Cas Coovadia, the managing director of the Banking Association of South Africa, said in a statement. “It also militates against the imperative of ensuring political and policy certainty.”

Zuma, who’s due to step down as head of the ANC in December and as president in 2019, previously downplayed suggestions that he intends to reorganize his cabinet and fire Gordhan.

Zuma-Gordhan Tensions

“Tensions are already high between Zuma and Gordhan and so this will just serve to deepen their mutual hostility,” said Susan Booysen, a professor at the University of Witwatersrand’s School of Governance.

Treasury spokeswoman Yolisa Tyantsi referred queries to the presidency when contacted by text message and email. Bongani Ngqulunga, the presidential spokesman, didn’t answer calls to his mobile phone.

“It sends a very negative message,” said Abdul Waheed Patel, managing director of Cape Town-based Ethicore Political Consulting. “If investors see there is no deviation from policy, it may not ruffle their feathers too much. What is creating uncertainty and discomfort is the way it’s being done.”