Asian equities fell and U.S. stock futures headed lower, extending the biggest selloff for global stocks in two years as investors adjusted to a surge in global bond yields.

Shares sank across the region, with Japan’s benchmarks falling the most in 15 months. S&P 500 Index futures pared a drop of as much as 0.9 percent, signaling Friday’s rout won’t extend for another day.

Shares in Hong Kong and Shanghai trimmed declines after China’s securities regulator urged brokerages to help stem the rout. Australia’s 10-year bond yield surged as the 10-year Treasury yield neared 2.87 percent after solid jobs data on Friday showed rising wages. The yen advanced.

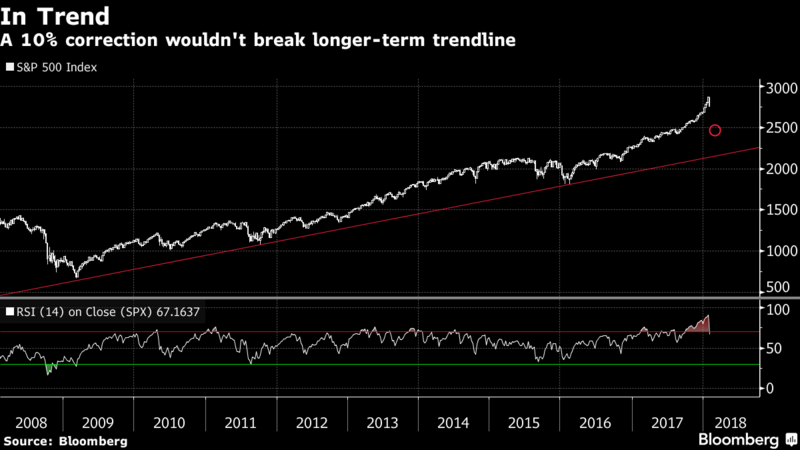

“It’s likely the pullback has further to go as investors adjust to more Fed tightening than currently assumed,” said Shane Oliver, Sydney-based global investment strategist at AMP Capital Investors Ltd., which oversees about A$179 billion ($141 billion). “The pullback is likely to be just an overdue correction, with say a 10 percent or so fall, rather than a severe bear market — providing the rise in bond yields is not too abrupt and recession is not imminent in the U.S. with profits continuing to rise.”

The re-pricing of markets has come as investors question whether the Federal Reserve will keep to a gradual pace of monetary tightening, and whether it may need to end up boosting interest rates by more than previously expected in coming years. A higher so-called terminal rate for the Fed’s target implies higher long-term yields — raising borrowing costs across the economy.

Yields on 10-year Treasuries have climbed to a four-year high from 2.40 percent at the start of the year. Last week’s decline for global stocks follows one of the best starts to a year on record amid hopes for ever-expanding corporate profits and growth in the world economy that’s broadening. The MSCI All Country World Index tumbled 3.4 percent last week, its biggest such slide since January 2016.

The China Securities Regulatory Commission is asking investors to add to their collateral to avert sharp declines in share prices as the nation’s leaders focus on stability in the nation’s $8 trillion stock market.

Elsewhere, oil extended declines after U.S. explorers raised the number of rigs drilling for crude to the most since August. Bitcoin dipped below $8,000.

Terminal users can read more in our markets blog.

Here are some key events scheduled for this week:

- Monetary policy decisions are due in Australia, Russia, India, Brazil, Poland, Romania, the U.K., New Zealand, Serbia, Peru, and the Philippines.

- Earnings season continues with reports from Bristol-Myers Squibb, Ryanair, Toyota Motor Corp., BNP Paribas, BP, General Motors, Walt Disney, SoftBank, Sanofi, Philip Morris, Total, Tesla, Rio Tinto, L’Oreal and Twitter.

- Dallas Fed President Robert Kaplan and New York Fed President William Dudley are among policy officials due to speak in New York.

These are the main moves in markets:

Stocks

- Japan’s Topix index declined 2.2 percent at the close and the Nikkei 225 Stock Average sank 2.6 percent, both chalking their biggest slides since November 2016.

- Hong Kong’s Hang Seng Index lost 1.2 percent and the Shanghai Composite Index rose 0.4 percent.

- South Korea’s Kospi index fell 1.3 percent.

- Australia’s S&P/ASX 200 Index dropped 1.6 percent at the close and New Zealand’s S&P/NZX 50 Index sank 2.1 percent.

- The MSCI Asia-Pacific Index fell 1.5 percent, set for its biggest decline since December 2016.

- Futures on the S&P 500 were 0.3 percent lower, paring an earlier slide, while Dow Jones Industrial Average contracts fell 0.5 percent.

Currencies

- The Bloomberg dollar spot index declined less than 0.1 percent.

- The yen was up 0.2 percent to 109.92 per dollar.

- The euro was little changed at $1.2458.

- The pound was steady at $1.4117.

- The Aussie was steady at 79.31 U.S. cents, trimming an earlier loss of as much as 0.5 percent.

Bonds

- The yield on 10-year Treasuries rose more than two basis point to 2.86 percent after climbing five basis points on Friday.

- Australia’s 10-year bond yield jumped more than 10 basis points to almost 2.94 percent.

Commodities

- West Texas Intermediate crude fell 0.9 percent to $64.87 barrel.

- Gold lost 0.1 percent to $1,332.32 an ounce.