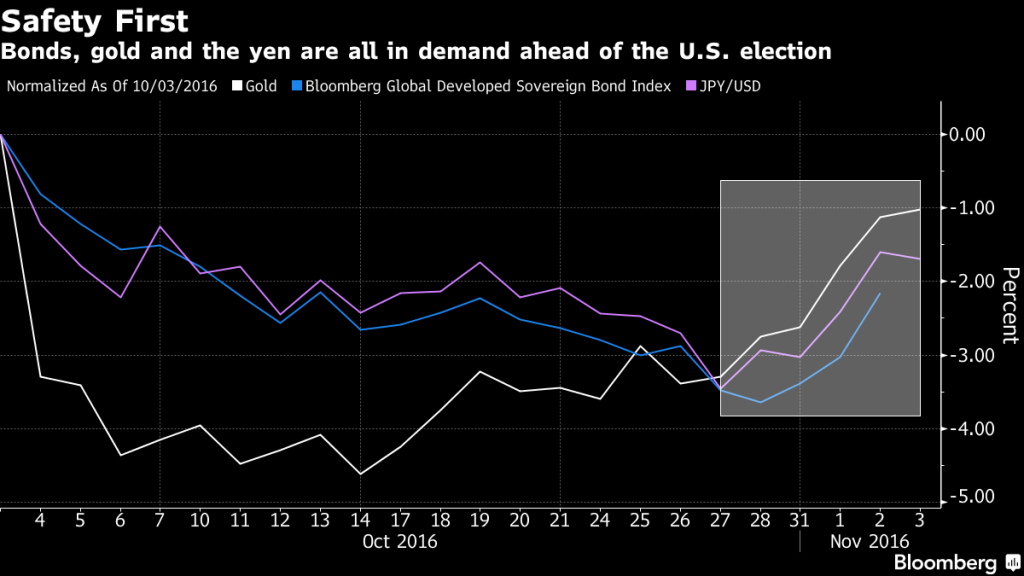

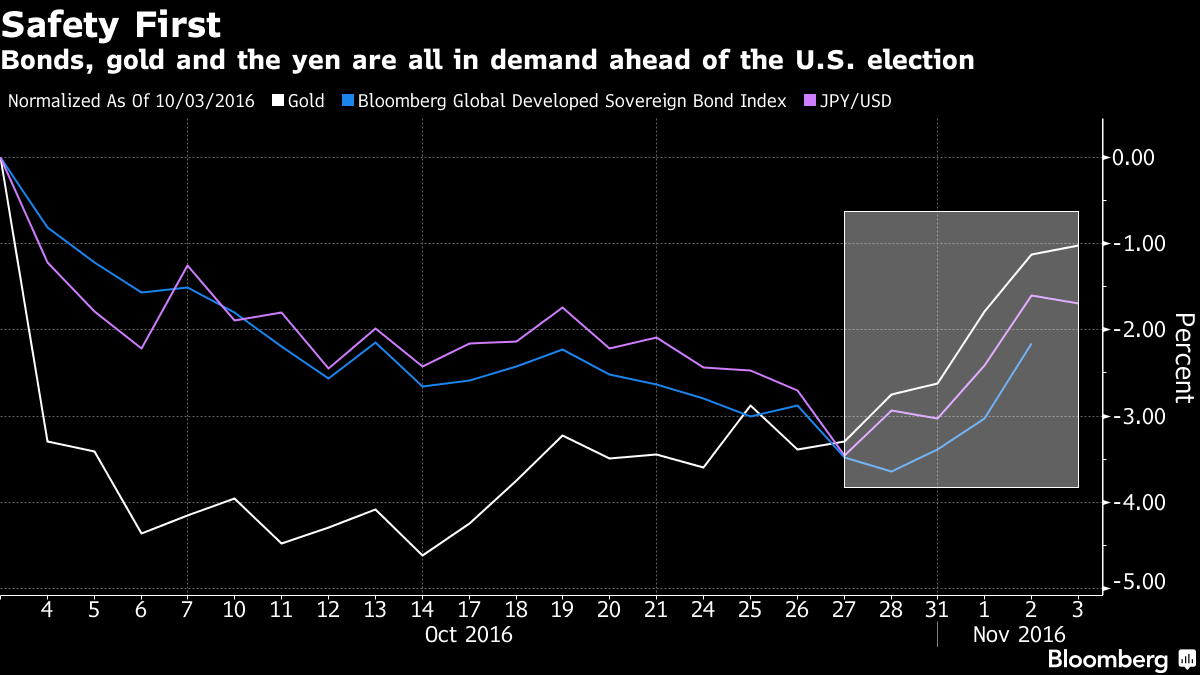

Investors are becoming more jittery amid a tightening race for the U.S. presidency, spurring demand for haven assets including the yen while weighing on stocks and Mexico’s peso. Egypt’s currency tumbled as the country switched to a freely floating exchange rate.

The yen climbed to a one-month high, U.S. equity index futures fell and the MSCI All Country World Index held near its lowest since July after Fox News reported that a Federal Bureau of Investigation probe involving Democratic nominee Hillary Clinton was intensifying. The peso weakened versus all major peers on concern Mexican exports will suffer if she loses, while Bloomberg’s dollar index dropped for a fifth day amid speculation the election’s fallout could deter the Federal Reserve from raising interest rates. Gold gained.

Investors turned more risk averse over the past week as voter surveys suggested Clinton’s once dominant lead over Donald Trump was faltering ahead of the Nov. 8 election. Poll aggregator FiveThirtyEight gives her a 68 percent chance of victory, 14 percentage points less than it estimated prior to a Friday announcement that the FBI had reopened a probe into her use of an unauthorized e-mail server while Secretary of State. Bets on a December interest-rate hike by the Fed were stepped up on Wednesday at the central bank left policy unchanged and signaled a December move was likely.

“U.S. political uncertainty ahead of next week’s election is weighing on markets,” said Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia in Sydney. “Most polls suggest the presidential election is turning out to be a closer call now compared to a few days ago following the controversy about Hillary Clinton’s e-mail investigation. In the short term, this should weigh on the dollar particularly versus the yen and euro.”

The FBI’s investigation into Clinton has taken on a very high priority, Fox News reported, citing unidentified sources. She led Trump 39 percent to 35 percent among independents surveyed Friday through Monday, the latest Purple Slice online poll for Bloomberg Politics showed.

Currencies

The Bloomberg Dollar Spot Index, which tracks the currency against 10 major peers, fell 0.2 percent as of 8:26 a.m. London time. The yen strengthened as much as 0.7 percent to a one-month high and South Korea’s won rebounded 0.7 percent from near to a three-month low. A JPMorgan Chase & Co. index of global currency volatility held at a seven-week high.

“The market’s concerned that the FBI investigation will swing next week’s election,” said Mansoor Mohi-uddin, a Singapore-based strategist at Royal Bank of Scotland Group Plc.

The Fed left rates on hold for a seventh consecutive meeting Wednesday and said in its statement it only needed “some” further evidence that inflation and employment were on track toward their goals before raising them. Futures contracts show a 78 percent likelihood of an increase in December, compared with 68 percent on Tuesday.

Mexico’s peso fell as much as 0.9 percent to its weakest level since September, reversing an earlier advance. The currency tends to fall when Trump’s prospects election prospects improve because he has pledged to revisit the North American Free Trade Agreement that governs commerce between the U.S. and Mexico.

The British pound added 0.3 percent before the Bank of England announces the outcome of a monetary policy review and updates its inflation projections. A 17 percent tumble in the pound since the U.K.’s June vote to leave the European Union has stoked expectations that consumer-price gains will accelerate.

The Egyptian pound weakened 33 percent as the central bank said it would switch to a freely floating exchange rate. The monetary authority also raised key lending rates by 300 basis points.

Stocks

Futures on the S&P 500 Index fell 0.1 percent following a seventh day of losses in the U.S. benchmark, its longest selloff since November 2011. Nasdaq 100 Index contracts declined 0.3 percent after Facebook Inc. slid in extended New York trading after reporting earnings. The social network predicted an uptick in costs and a slowdown in advertising sales growth.

The Stoxx Europe 600 Index fluctuated following an eight-day losing streak. Credit Suisse Group AG fell 3.9 percent after reporting earnings, while ING Groep NV gained 3.6 percent and Societe Generale SA surged 4.8 percent.

Asia ex-Japan stocks held near their lowest level since September after sliding 1.4 percent in the last session. New Zealand’s benchmark stock gauge entered a correction, while Japanese markets were shut for a holiday. Hong Kong’s Hang Seng Index slipped to its lowest level since August and Wynn Macau Ltd. dropped by the most since August after reporting a profit that trailed analysts’ estimates.

“The move to take risk off the table continues,” Chris Weston, chief market strategist in Melbourne at IG Ltd., said in an e-mail to clients. “We have reached a point where there is a buyers strike, where money managers have reduced their risk, increased cash allocations within the portfolio and are happy to ride out this mini-storm of uncertainty.”

Commodities

Gold climbed for a sixth day, approaching $1,300 an ounce in its longest winning streak since September.

“Gold was stronger on the back of safe-haven buying as opinion polls on the U.S. election continued to show Trump gaining,” Australia & New Zealand Banking Group Ltd. said in a note. “Weak equity markets also helped improve investor appetite.”

Crude oil advanced 0.4 percent to $45.50 a barrel. It tumbled 2.9 percent in the last session as data showed U.S. inventories rose by 14.4 million barrels last week, the biggest gain in data going back to 1982 and more than the 2 million barrel increase forecast in a Bloomberg survey. Record OPEC output last month is also damping the outlook for oil, complicating the group’s effort to stabilize prices.

Bonds

The yield on U.S. Treasuries due in a decade was little changed at a one-week low of 1.80 percent.

Australia’s 10-year yield fell four basis points to 2.30 percent. Similar-maturity notes fell in Italy, Portugal and Spain.